Credit history report sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Understanding what a credit history report is and its impact is crucial in navigating the financial landscape. Let’s dive into the depths of this essential document and unravel its secrets.

Understanding Credit History Report

So, what’s the deal with credit history reports, you ask? Well, lemme break it down for ya.

A credit history report is like your financial report card, showing your creditworthiness and how responsible you are with money. It’s a record of your borrowing and repayment history, used by lenders to determine if you’re a risky bet or a safe bet when it comes to lending you money.

Information in a Credit History Report

- Your personal info like name, address, and social security number.

- Details on your credit accounts, like credit cards, loans, and mortgages.

- Payment history, showing if you pay on time or if you’re always running late.

- Any collections or public records, like bankruptcies or foreclosures.

Importance of Monitoring Your Credit History Report

Listen up, keeping an eye on your credit history report is crucial, yo. It can affect your ability to get a loan, rent an apartment, or even land a job. Having a good credit history report can open doors for you, while a bad one can slam ‘em shut real quick.

Obtaining a Credit History Report

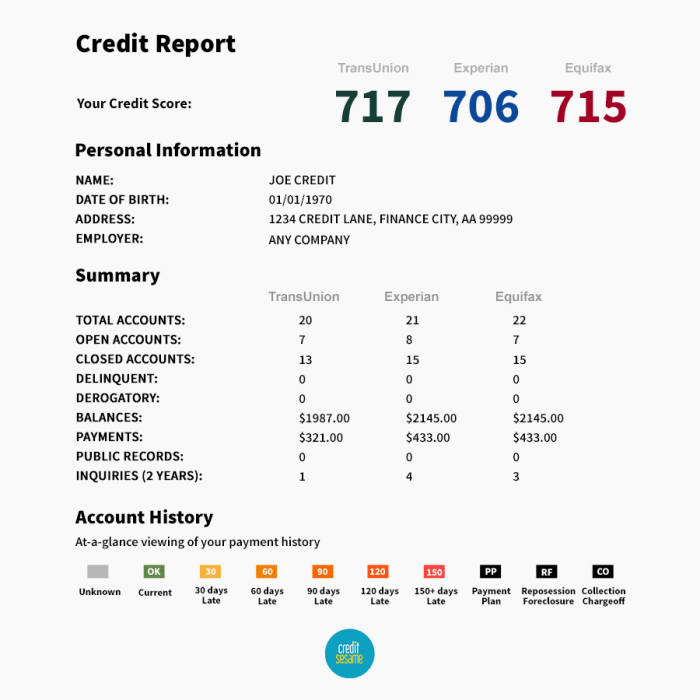

To obtain a credit history report, individuals can request a report from one of the major credit bureaus, including Equifax, Experian, or TransUnion. They can request a free report once a year from each bureau through AnnualCreditReport.com.

Difference Between Soft and Hard Inquiries

- A soft inquiry occurs when an individual or a creditor checks their own credit report, or when a potential lender pre-approves a credit offer without your consent. Soft inquiries do not affect credit scores.

- On the other hand, a hard inquiry happens when an individual applies for credit, such as a loan or credit card. Hard inquiries can impact credit scores and remain on the credit report for up to two years.

Frequency of Checking Credit History Report

Individuals should check their credit history report at least once a year to monitor for errors, inaccuracies, or potential identity theft. Regularly monitoring the report can help individuals maintain a healthy credit score and address any issues promptly.

Factors Impacting Credit History Report

When it comes to your credit history report, there are several key factors that can significantly impact your overall credit score and financial health. Understanding these factors is crucial for maintaining a positive credit profile and achieving your financial goals.

Financial Behaviors Impacting Credit History Report

- On-time Payments: One of the most important factors in your credit history report is your payment history. Making on-time payments consistently shows lenders that you are responsible and can be trusted to repay debts.

- Credit Utilization: Your credit utilization ratio, which is the amount of credit you are using compared to the total amount available to you, also plays a significant role in your credit score. Keeping this ratio low can help improve your credit score.

- Credit Mix: The types of credit accounts you have, such as credit cards, loans, and mortgages, can impact your credit history report. Having a diverse mix of credit accounts can demonstrate your ability to manage different types of debt responsibly.

Errors in Credit History Report

Errors or inaccuracies in your credit history report can have a negative impact on your credit score and ability to access credit. It’s essential to regularly review your credit report for any mistakes and take steps to address them promptly.

Improving Credit History Report

Improving your credit history report is essential for your financial well-being. A positive credit history can open doors to better interest rates, loan approvals, and more financial opportunities. Here are some tips to help you improve your credit history report:

Build and Maintain Positive Credit History

- Pay your bills on time: Late payments can have a negative impact on your credit score. Make sure to pay all your bills on time to maintain a positive credit history.

- Keep your credit card balances low: High credit card balances can negatively affect your credit utilization ratio. Try to keep your credit card balances below 30% of your credit limit.

- Monitor your credit report regularly: Check your credit report for errors or inaccuracies that could be dragging down your credit score. Dispute any errors you find to help improve your credit history.

Strategies for Rebuilding Poor Credit History

- Start by paying off outstanding debts: Focus on paying off any outstanding debts to improve your credit utilization ratio and show lenders that you are responsible with your finances.

- Consider a secured credit card: A secured credit card can help you rebuild your credit by making on-time payments and keeping your credit utilization low.

- Work with a credit counselor: A credit counselor can help you create a plan to improve your credit history and provide guidance on managing your finances more effectively.