Diving into the realm of fixed vs variable loan rates, get ready to explore the ins and outs of these financial tools. From understanding the basics to delving into the pros and cons, this topic is sure to keep you on your toes.

As we uncover the factors to consider and the risks and benefits associated with each type of loan rate, you’ll gain a deeper insight into making informed financial decisions.

Fixed vs Variable Loan Rates

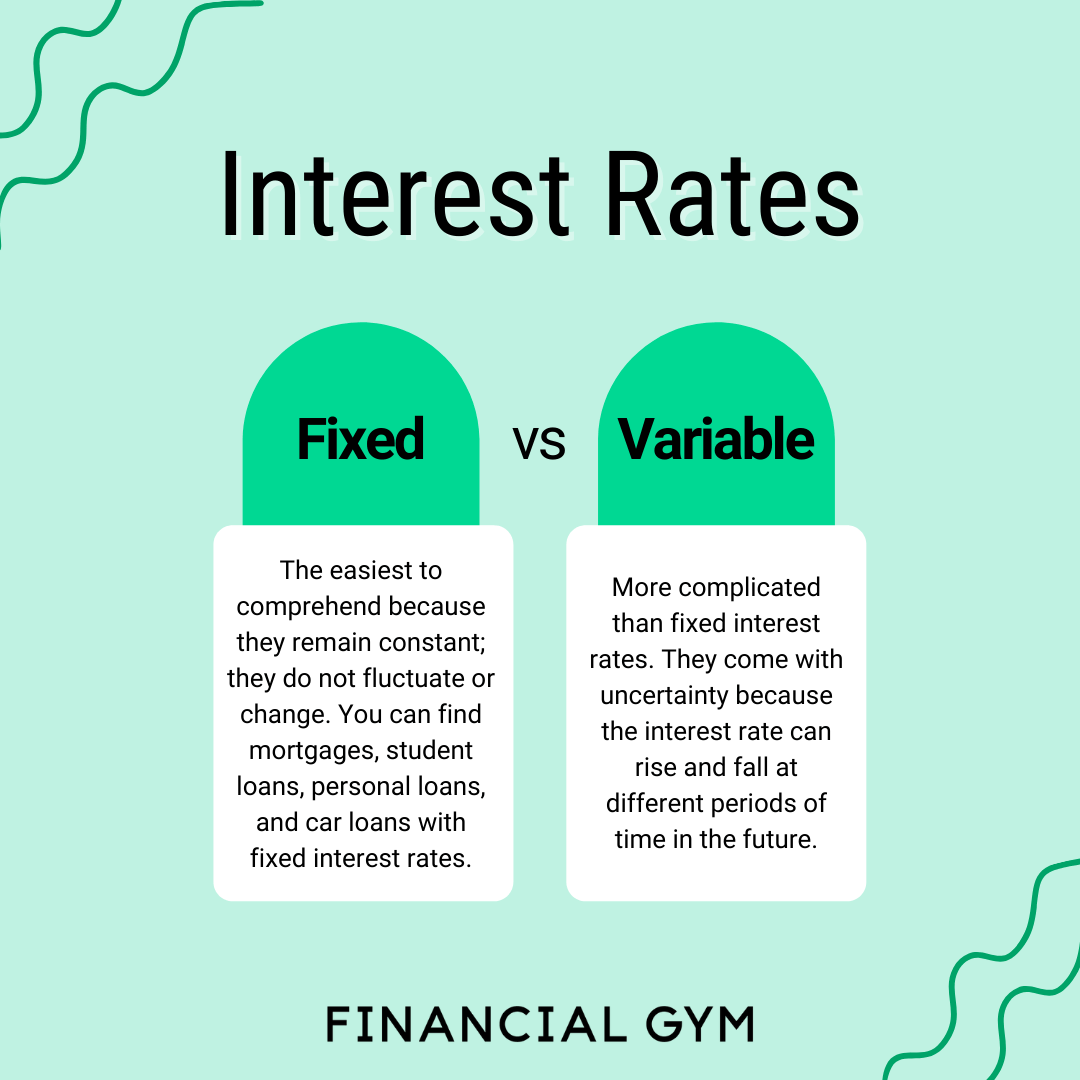

When it comes to loans, borrowers often have to choose between fixed and variable loan rates. Let’s dive into the details of each to understand the differences.

Fixed Loan Rates

Fixed loan rates are interest rates that remain the same throughout the life of the loan. This means that your monthly payments will also remain constant, providing stability and predictability. Even if market interest rates rise, your rate will stay fixed.

Variable Loan Rates

On the other hand, variable loan rates fluctuate based on changes in market interest rates. This means that your monthly payments can vary, sometimes increasing if interest rates go up or decreasing if they go down. While variable rates may start lower than fixed rates, they come with the risk of rising in the future.

Advantages and Disadvantages

- Fixed Rates:

- Advantages:

- Stability and predictability in monthly payments.

- Protection against rising interest rates.

- Disadvantages:

- Initial rates may be higher than variable rates.

- No benefit if market rates decrease.

- Advantages:

- Variable Rates:

- Advantages:

- Potential for lower initial rates.

- Chance to benefit if market rates decrease.

- Disadvantages:

- Risk of increasing payments if market rates rise.

- Less predictability in monthly payments.

- Advantages:

Factors to Consider

When deciding between fixed and variable loan rates, several factors come into play that can influence the choice. Understanding these factors is crucial to making an informed decision that aligns with your financial goals and risk tolerance.

Interest Rate Environment

The current economic conditions play a significant role in determining whether fixed or variable rates are more favorable. In a rising interest rate environment, fixed rates provide stability and protection against future rate hikes. On the other hand, in a declining rate environment, variable rates may offer lower initial rates and potential savings over time.

Loan Duration

The length of time you plan to hold the loan can impact the choice between fixed and variable rates. If you intend to pay off the loan quickly, a variable rate may be more attractive due to the potential for lower initial rates. However, for longer loan terms, fixed rates provide certainty and protection against interest rate fluctuations.

Risk Tolerance

Your risk tolerance and financial situation also play a crucial role in selecting between fixed and variable rates. If you prefer predictability and are not comfortable with the uncertainty of variable rates, a fixed rate may be more suitable. Conversely, if you are willing to take on some risk for the possibility of lower rates, a variable rate might be preferred.

Financial Goals

Consider your long-term financial goals when choosing between fixed and variable rates. If you prioritize stability and want to lock in a consistent payment amount, a fixed rate can help you achieve that. On the other hand, if you are looking to save on interest costs and are willing to take on some risk, a variable rate could align better with your financial objectives.

Examples of Scenarios

– Buying a first home: Opting for a fixed rate can provide peace of mind and stability in monthly mortgage payments, especially for first-time homebuyers who may be unfamiliar with the market.

– Refinancing for a short-term loan: If you plan to refinance your loan in a few years, a variable rate can offer lower initial rates and potential cost savings before you pay off the loan.

Risks and Benefits

When it comes to choosing between fixed and variable loan rates, there are risks and benefits to consider for each option.

Risks of Fixed Loan Rates

Fixed loan rates can provide stability and predictability in monthly payments, but they also come with certain risks:

- Missed Opportunity for Lower Rates: If interest rates drop, you may end up paying more than necessary with a fixed rate loan.

- Higher Initial Rates: Fixed rates tend to be higher initially compared to variable rates, which can result in higher payments at the start of the loan term.

- Early Repayment Penalties: Some fixed-rate loans may have penalties for paying off the loan early, restricting your flexibility.

Benefits of Variable Loan Rates

Variable loan rates offer flexibility and potential savings, but they also carry their own set of benefits:

- Potential for Lower Rates: Variable rates can decrease if market interest rates go down, leading to lower monthly payments.

- Lower Initial Rates: Variable rates typically start lower than fixed rates, allowing for more affordable payments initially.

- No Early Repayment Penalties: Variable rate loans often do not have penalties for early repayment, giving you more freedom to pay off the loan sooner.

Strategies to Mitigate Risks

Regardless of the type of loan rate you choose, there are strategies to help mitigate the associated risks:

- Diversification: Consider diversifying your investments to offset potential losses from rising interest rates with a fixed-rate loan.

- Monitor the Market: Stay informed about economic trends and interest rate changes to make informed decisions about variable rates.

- Refinancing Options: Explore refinancing opportunities to switch between fixed and variable rates if needed to better align with your financial goals.

Market Trends

In the world of fixed and variable loan rates, keeping an eye on market trends is crucial. Let’s dive into how current trends impact these rates differently and what historical data can tell us about the future.

Interest Rate Fluctuations

Interest rate fluctuations can have a significant impact on both fixed and variable loan rates. When interest rates rise, borrowers with fixed-rate loans are shielded from the increase, as their rates remain constant. On the other hand, borrowers with variable-rate loans see their rates go up, leading to higher monthly payments.

It’s like a game of cat and mouse – fixed-rate loans stay steady while variable-rate loans dance to the tune of the market.

Historical Data and Future Trends

Looking back at historical data can provide insights into how fixed and variable loan rates have behaved over time. By analyzing past trends, experts can make educated predictions about the future direction of these rates. For example, if interest rates have been steadily increasing in the past, it’s likely that fixed-rate loans will become more attractive to borrowers looking for stability. On the other hand, if rates have been fluctuating, variable-rate loans might be a riskier but potentially cost-saving option.