Diving into the world of loan consolidation strategies, we’ll explore the ins and outs of how to effectively manage your debts and pave the way to financial freedom. Buckle up as we break down the complexities and nuances of consolidating loans in a way that’s easy to understand and implement.

In the following sections, we’ll cover everything from different types of loans that can be consolidated to key factors to consider before diving into the consolidation process. Let’s get started on this journey towards a debt-free future.

Overview of Loan Consolidation Strategies

When it comes to managing multiple loans, loan consolidation can be a game-changer. This strategy involves combining all your existing loans into a single new loan, usually with a lower interest rate and more manageable monthly payments.

Types of Loans that Can Be Consolidated

- Student Loans: Both federal and private student loans can be consolidated to simplify repayment.

- Credit Card Debt: High-interest credit card debt can be rolled into a consolidation loan for lower interest rates.

- Personal Loans: If you have multiple personal loans, consolidating them can streamline your finances.

- Medical Bills: Unpaid medical bills can also be consolidated into a single loan for easier repayment.

Primary Goals of Loan Consolidation Strategies

- Lower Interest Rates: By consolidating multiple loans, you may qualify for a lower overall interest rate, saving you money in the long run.

- Simplified Repayment: Managing one loan payment each month is much easier than juggling multiple payments with different due dates and amounts.

- Reduced Monthly Payments: Consolidation can often lead to lower monthly payments, making it easier to stay on top of your financial obligations.

- Improved Credit Score: Making timely payments on a consolidated loan can positively impact your credit score over time.

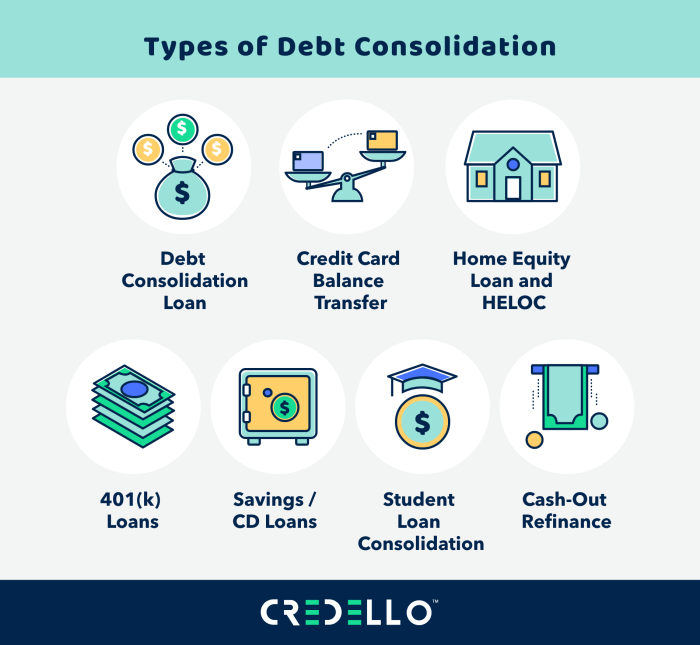

Types of Loan Consolidation Options

When it comes to consolidating your loans, you’ve got a few options to choose from. Let’s break down the different types available so you can make an informed decision on how to tackle your debt.

Debt Consolidation Loans vs. Balance Transfer Credit Cards

If you’re considering consolidating your debt, you might be looking at either a debt consolidation loan or a balance transfer credit card. Here’s a quick comparison between the two:

- A debt consolidation loan involves taking out a new loan to pay off your existing debts. This new loan typically has a lower interest rate, making it easier to manage your payments and potentially save money in the long run.

- On the other hand, a balance transfer credit card allows you to transfer your existing credit card balances to a new card with a low or 0% introductory interest rate. This can help you pay off your debt faster without accruing additional interest.

It’s important to compare the interest rates, fees, and repayment terms of both options to determine which one is the best fit for your financial situation.

Refinancing Loans for Consolidation

Refinancing your loans for consolidation involves replacing one or more existing loans with a new loan that has better terms. This can help lower your monthly payments, reduce your interest rate, and simplify your debt repayment process. By refinancing, you may be able to save money on interest over time and pay off your debt more efficiently.

Government-Backed Consolidation Programs

There are various government-backed consolidation programs available to help individuals manage their debt more effectively. Examples include:

- The Federal Direct Consolidation Loan Program, which allows borrowers to combine multiple federal student loans into one loan with a fixed interest rate.

- The Income-Driven Repayment (IDR) Plan for federal student loans, which bases monthly payments on your income and family size, making repayment more affordable.

Factors to Consider Before Consolidating Loans

When thinking about consolidating your loans, there are several important factors to take into consideration to make the best decision for your financial situation.

Credit Score Importance in Loan Consolidation

Maintaining a good credit score is crucial when considering loan consolidation. Lenders often use your credit score to determine your eligibility for a consolidation loan and the interest rate you will receive. A higher credit score can lead to better consolidation options with lower interest rates, saving you money in the long run.

Role of Interest Rates in Choosing the Right Consolidation Option

Interest rates play a significant role in determining the cost of your consolidated loan. When exploring consolidation options, compare the interest rates offered by different lenders. Opting for a consolidation loan with a lower interest rate can help you save money on interest payments over time, making it easier to pay off your debt.

Risks and Drawbacks Associated with Loan Consolidation Strategies

While loan consolidation can offer benefits such as simplifying your repayment process and potentially lowering your monthly payments, there are also risks to consider. Consolidating your loans may extend the repayment period, resulting in paying more interest over time. Additionally, if you consolidate unsecured debts into a secured loan, such as a home equity loan, you run the risk of losing your collateral if you default on the loan.

Steps to Consolidate Loans Effectively

When it comes to consolidating multiple loans, following a step-by-step process is crucial to ensure a smooth and successful consolidation. By consolidating your loans, you can simplify your payments, potentially lower your interest rates, and even extend your repayment term.

1. Assess Your Current Loans

Before you begin the consolidation process, gather all the necessary information about your current loans. This includes the outstanding balances, interest rates, and repayment terms for each loan. Understanding the details of your existing loans will help you determine the best consolidation strategy.

2. Research Loan Consolidation Options

Next, research different loan consolidation options available to you. This could include federal consolidation loans, private consolidation loans, or balance transfer credit cards. Compare the terms, interest rates, and benefits of each option to choose the one that suits your financial situation best.

3. Contact Lenders for Negotiation

Once you’ve decided on a consolidation option, reach out to your lenders to negotiate better terms. This could involve requesting lower interest rates, flexible repayment options, or even discounts for timely payments. Negotiating with lenders can help you secure a more favorable consolidation deal.

4. Apply for the Consolidation Loan

After finalizing the terms with your lenders, proceed to apply for the consolidation loan. Submit all the required documents and information accurately to expedite the approval process. Make sure to double-check the terms and conditions before signing the agreement.

5. Make Timely Payments

Once your consolidation loan is approved, make sure to make timely payments to avoid any late fees or penalties. Set up automatic payments if possible to ensure you never miss a payment. Consistent and on-time payments will help you stay on track with your new consolidated loan.

6. Avoid Common Pitfalls

During the loan consolidation process, be mindful of common pitfalls such as taking on more debt, ignoring the terms of the new loan, or missing payments. Stay disciplined with your finances and stick to the repayment plan to successfully consolidate your loans without any setbacks.