Diving into the world of 401(k) investment options, get ready to uncover the secrets to building your financial future like a boss. From understanding the basics to strategizing for success, this article is your ultimate guide to making the most of your 401(k) plan.

Whether you’re a newbie or a seasoned investor, there’s something here for everyone looking to level up their investment game and secure a brighter tomorrow.

Understanding 401(k) Investment Options

401(k) investment options refer to the choices available to individuals regarding where to invest their retirement savings within a 401(k) plan. These options typically include a variety of investment vehicles such as stocks, bonds, mutual funds, and target-date funds.

Types of 401(k) Investment Options

When it comes to 401(k) investment options, individuals can choose from a range of assets including:

- Stocks: Represent ownership in a company and offer potential for high returns but also come with high risk.

- Bonds: Debt securities issued by governments or corporations that provide regular interest payments and are considered less risky than stocks.

- Mutual Funds: Pooled investments that allow individuals to invest in a diversified portfolio managed by professionals.

- Target-Date Funds: Investment funds that automatically adjust the asset allocation based on the individual’s retirement date, becoming more conservative as retirement approaches.

Importance of Diversification in 401(k) Investment

Diversification is crucial when selecting 401(k) investment options as it helps spread risk across different asset classes. By diversifying investments, individuals can reduce the impact of volatility in any single asset and potentially enhance long-term returns. It is essential to have a mix of assets in a 401(k) portfolio to achieve a balance between risk and return.

Risk Factors in 401(k) Investment Options

Different investment options within a 401(k) plan come with varying levels of risk. Stocks are considered the riskiest due to their volatile nature, while bonds are typically less risky but offer lower returns. Mutual funds provide diversification but still carry some risk depending on the underlying assets. It’s important for individuals to assess their risk tolerance and investment goals when choosing among 401(k) investment options.

Types of 401(k) Investment Options

When it comes to 401(k) investment options, there are several categories to consider. Let’s explore some common options and how they differ.

Mutual Funds

Mutual funds are a popular choice in 401(k) plans. These are professionally managed investment funds that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. They are actively managed, meaning a fund manager makes decisions on which assets to buy and sell.

Index Funds

Index funds, on the other hand, are passively managed funds that aim to replicate the performance of a specific market index, such as the S&P 500. They have lower fees compared to actively managed funds since they do not require as much hands-on management.

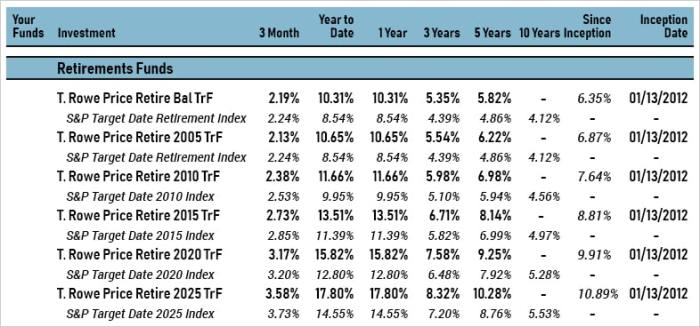

Target-Date Funds

Target-date funds are designed to adjust their asset allocation based on the investor’s target retirement date. As the investor gets closer to retirement, the fund automatically shifts towards a more conservative investment mix to reduce risk. These funds are a convenient option for those who prefer a hands-off approach to investing.

Employer Stock

Some 401(k) plans offer the option to invest in the employer’s stock. While this can provide an opportunity to potentially benefit from the company’s success, it also comes with risks. Investing a significant portion of your retirement savings in a single stock can expose you to concentration risk if the company underperforms.

Overall, understanding the different types of 401(k) investment options and their characteristics can help you make informed decisions about how to allocate your retirement savings.

Factors to Consider When Choosing 401(k) Investment Options

When selecting 401(k) investment options, several factors should be taken into account to ensure alignment with your financial goals and retirement plans.

Personal Financial Goals

- Identifying short-term and long-term financial objectives.

- Considering risk tolerance and investment preferences.

- Aligning investment choices with retirement timeline and age.

Impact of Investment Fees

- High investment fees can significantly reduce long-term returns within a 401(k) plan.

- Monitoring and comparing fees across different investment options is crucial for maximizing returns.

- Choosing low-cost index funds or ETFs can help minimize the impact of fees on your investment growth.

Investment Risk Tolerance

- Evaluating your comfort level with market fluctuations and potential investment losses.

- Understanding the relationship between risk and return to make informed decisions.

- Balancing risk tolerance with the need for growth and capital preservation in your investment portfolio.

Alignment with Retirement Timeline and Age

- Considering the number of years until retirement and adjusting investment strategies accordingly.

- Gradually shifting towards more conservative investments as you approach retirement age to protect accumulated savings.

- Reassessing and realigning investment options periodically based on changing financial goals and market conditions.

Strategies for Optimizing 401(k) Investment Options

Investing in your 401(k) is crucial for your financial future, but it’s not a set-it-and-forget-it deal. Here are some strategies to make the most out of your investment options.

Regularly Review and Adjust Investment Options

- Check your investments at least once a year to ensure they align with your goals and risk tolerance.

- Consider adjusting your portfolio based on market conditions or changes in your financial situation.

Automatic Contribution Increases and Rebalancing

- Set up automatic contribution increases to boost your savings without even thinking about it.

- Rebalance your portfolio periodically to maintain your desired asset allocation and risk level.

Asset Allocation and Its Role

- Asset allocation is the mix of stocks, bonds, and other investments in your portfolio.

- Diversifying your investments can help manage risk and potentially increase returns over the long term.

Maximizing Employer Matching Contributions

- Contribute enough to your 401(k) to get the full match from your employer – it’s essentially free money!

- Choose investment options that align with your long-term goals while taking advantage of employer contributions.