Buckle up, folks! We’re about to dive into the world of financial hedging strategies, where risks meet rewards and smart decisions rule the game. Get ready for a rollercoaster ride of insights and strategies that will leave you craving for more.

In this detailed guide, we’ll explore the ins and outs of financial hedging strategies, from the basics to real-world examples that showcase their impact in the financial market.

Introduction to Financial Hedging Strategies

Financial hedging strategies are techniques used by investors to reduce or eliminate the risk associated with their investment portfolios. By entering into hedging contracts, investors can protect themselves against potential losses caused by fluctuations in the market.

Importance of Hedging in Financial Markets

Hedging is crucial in financial markets as it helps investors manage risk effectively. It provides a way to safeguard investments from unexpected events or market volatility, ensuring a more stable return on investment.

- Hedging allows investors to protect themselves from adverse market movements.

- It helps in minimizing potential losses while still allowing for potential gains.

- By hedging, investors can maintain a more predictable and consistent investment performance.

Primary Objectives of Using Hedging Strategies

When employing hedging strategies, investors aim to achieve specific goals to safeguard their investments and optimize returns.

- Protecting against downside risk: Hedging helps investors limit losses during market downturns.

- Enhancing portfolio stability: By hedging, investors can reduce the overall volatility of their portfolios.

- Preserving capital: Hedging strategies are utilized to safeguard the initial capital invested.

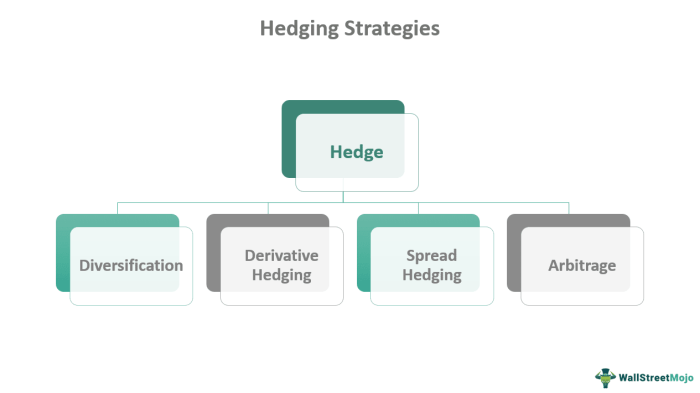

Types of Financial Hedging Strategies

When it comes to financial hedging strategies, there are several types that companies and investors can utilize to manage risk and protect their investments. Let’s explore some of the most common ones and how they work.

Forward Contracts

Forward contracts are agreements between two parties to buy or sell an asset at a specified price on a future date. For example, a company may enter into a forward contract to lock in the price of a commodity like oil to hedge against price fluctuations. While this strategy can help mitigate risk, it also comes with the potential downside of being locked into a price that may not be favorable in the future.

Options

Options give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time frame. For instance, a company may purchase a call option to buy a stock at a certain price in the future to hedge against potential price increases. Options provide flexibility and limited risk, as the holder can choose whether or not to exercise the option.

Futures

Futures contracts are similar to forward contracts but are standardized and traded on exchanges. They require both parties to fulfill the contract on the specified date. For instance, an investor may buy a futures contract to lock in the price of a stock index to hedge against market fluctuations. Futures offer liquidity and transparency but also carry the risk of margin calls and potential losses.

Each type of financial hedging strategy comes with its own set of risks and benefits. It is essential for companies and investors to carefully consider their financial goals, risk tolerance, and market conditions before choosing the most suitable strategy to protect their investments.

Factors Influencing the Choice of Hedging Strategy

When it comes to selecting a hedging strategy, there are several key factors that come into play. These factors can greatly influence the decision-making process and ultimately determine the effectiveness of the chosen strategy.

Market conditions play a crucial role in determining the most suitable hedging strategy. Volatility, liquidity, interest rates, and overall economic conditions can impact the effectiveness of different hedging techniques. For example, in a highly volatile market, options may be more effective than futures contracts due to their flexibility.

The characteristics of the underlying asset also play a significant role in selecting a hedging strategy. Factors such as correlation to the market, sensitivity to certain economic indicators, and risk exposure can affect the choice of strategy. For instance, if an asset is highly correlated to a specific commodity, using commodity futures to hedge against price fluctuations may be more appropriate than using currency options.

Impact of Market Conditions

Market conditions, such as volatility and interest rates, directly influence the choice of hedging strategy. In times of high volatility, options may be preferred for their flexibility, while during stable market conditions, futures contracts could be more suitable.

- Volatility: High volatility may lead to increased use of options for hedging.

- Interest Rates: Fluctuations in interest rates can impact the cost of certain hedging instruments.

- Economic Conditions: Overall economic stability or instability can affect the effectiveness of different hedging strategies.

It is essential to assess current market conditions before deciding on a specific hedging strategy to ensure its effectiveness.

Role of Underlying Asset Characteristics

The characteristics of the underlying asset heavily influence the choice of hedging strategy. Understanding the asset’s correlation to the market, sensitivity to external factors, and risk exposure is crucial in determining the most effective hedging approach.

- Correlation to the Market: Assets with high correlation to specific markets may require tailored hedging strategies.

- Sensitivity to Economic Indicators: Assets sensitive to economic indicators may benefit from hedging techniques aligned with those indicators.

- Risk Exposure: Assets with higher risk exposure may necessitate more comprehensive hedging strategies to mitigate potential losses.

Implementation of Financial Hedging Strategies

Implementing a financial hedging strategy involves several key steps to effectively manage risk and protect against potential losses. Companies need to carefully plan and execute their hedging strategies to achieve their financial goals.

Steps in Implementing a Financial Hedging Strategy

When implementing a financial hedging strategy, companies typically follow these steps:

- Identify the specific risk exposure that needs to be hedged.

- Choose the appropriate financial instruments or derivatives to hedge against the identified risk.

- Develop a clear hedging strategy that aligns with the company’s financial objectives.

- Monitor and evaluate the effectiveness of the hedging strategy regularly.

- Adjust the hedging strategy as needed based on changes in market conditions or the company’s financial position.

Example: Hedging Currency Exposure Using Options

Let’s consider a company that operates internationally and is exposed to currency fluctuations. To hedge its currency exposure using options, the company can:

- Purchase call options to protect against a potential increase in the value of a foreign currency.

- Buy put options to safeguard against a decline in the value of a foreign currency.

- Set a predetermined exchange rate at which the options can be exercised to mitigate currency risk.

Challenges and Considerations in Implementing Hedging Strategies

Implementing hedging strategies effectively can be challenging due to various factors:

- Market volatility can impact the outcomes of hedging strategies.

- Incorrect assessment of risk exposure may lead to ineffective hedging.

- Costs associated with hedging instruments can affect overall financial performance.

- Regulatory changes and accounting standards may influence the implementation of hedging strategies.

Risk Management and Financial Hedging

Risk management and financial hedging go hand in hand when it comes to protecting a company from various risks that could impact its financial health. By utilizing hedging strategies, companies can effectively manage and mitigate risks such as currency risk and interest rate risk.

Mitigating Currency Risk

When a company engages in international trade, it is exposed to currency risk due to fluctuations in exchange rates. To mitigate this risk, companies can use financial hedging strategies such as forward contracts or options to lock in favorable exchange rates for future transactions. For example, a U.S.-based company that imports goods from Europe may use a forward contract to secure a fixed exchange rate, protecting itself from potential losses if the euro strengthens against the dollar.

Managing Interest Rate Risk

Interest rate risk refers to the potential impact of interest rate fluctuations on a company’s borrowing costs and investments. Companies can hedge against interest rate risk by using financial instruments like interest rate swaps or futures contracts. For instance, a company with a variable-rate loan may enter into an interest rate swap to convert it into a fixed-rate loan, reducing the uncertainty of future interest payments.

Real-World Examples

One notable example of effective risk management through financial hedging is the case of airlines hedging against fuel price fluctuations. Airlines often use derivatives contracts to lock in fuel prices at a certain level, protecting themselves from sudden spikes in oil prices that could significantly impact their operating costs. By utilizing hedging strategies, airlines can stabilize their expenses and improve their overall financial performance.

Performance Evaluation of Financial Hedging Strategies

When evaluating the performance of financial hedging strategies, it is essential to consider various methods and key metrics to assess their effectiveness in managing risks.

Methods for Evaluating Hedging Strategy Performance

- Historical Analysis: Examining past performance to determine how well the hedging strategy has worked in different market conditions.

- Scenario Analysis: Conducting stress tests by simulating different market scenarios to evaluate the strategy’s resilience.

- Value-at-Risk (VaR): Calculating the potential losses within a specific confidence interval to assess the risk exposure of the hedged portfolio.

Key Metrics and Indicators for Assessing Effectiveness

- Correlation Coefficient: Measuring the relationship between the hedged asset and the hedge instrument to determine the effectiveness of the hedge.

- Hedge Effectiveness Ratio: Calculating the percentage reduction in risk achieved by the hedging strategy to gauge its efficiency.

- Profit and Loss (P&L) Analysis: Evaluating the impact of the hedge on the overall portfolio returns to assess its contribution.

Case Study: Evaluation of a Hedging Strategy in a Volatile Market

Consider a scenario where a company hedges its foreign currency exposure using a currency forward contract during a period of high market volatility. By analyzing the hedged portfolio’s performance compared to an unhedged one, it is possible to assess the effectiveness of the hedging strategy in mitigating currency risk and preserving value.