Diving into the world of financial asset classes, get ready for a rollercoaster ride through the ins and outs of investments that will leave you wanting more.

Get ready to explore the different types of financial assets, from equities to fixed income securities and real assets, in a way that’s both informative and entertaining.

Overview of Financial Asset Classes

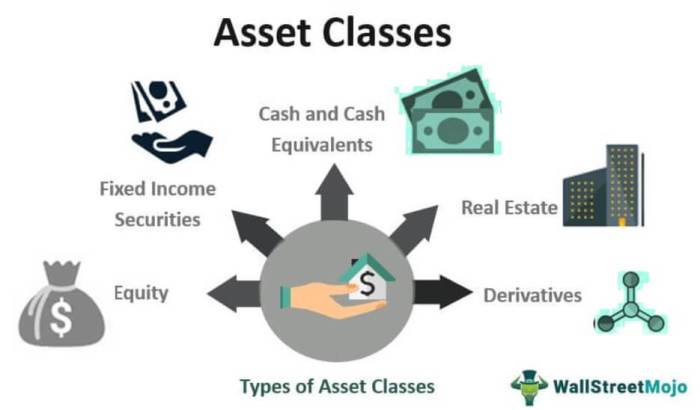

Financial asset classes are different categories of assets that investors can use to build their investment portfolios. These asset classes play a crucial role in diversifying investment risk and achieving financial goals.

Types of Financial Asset Classes

- Equities: Equities represent ownership in a company and are traded on stock exchanges. They offer the potential for high returns but come with higher risk due to market volatility.

- Bonds: Bonds are debt securities issued by governments, corporations, or municipalities. They provide a fixed income stream and are considered less risky than equities.

- Real Estate: Real estate investments involve purchasing properties for rental income or capital appreciation. They offer diversification and potential for long-term growth.

- Commodities: Commodities include physical goods like gold, oil, and agricultural products. They can serve as a hedge against inflation and provide portfolio diversification.

- Cash Equivalents: Cash equivalents are highly liquid assets like Treasury bills and money market funds. They offer stability and safety but provide lower returns.

Characteristics of Financial Asset Classes

- Equities: High return potential, high volatility, ownership in a company.

- Bonds: Fixed income, lower risk, repayment of principal at maturity.

- Real Estate: Tangible assets, potential rental income, capital appreciation.

- Commodities: Physical goods, inflation hedge, supply and demand-driven prices.

- Cash Equivalents: High liquidity, low risk, stable value.

Equities as a Financial Asset Class

Equities, also known as stocks, represent ownership in a company. When you invest in equities, you are essentially buying a share of that company’s ownership. Equities function as an asset class by providing investors with the opportunity to participate in the company’s profits through dividends and capital appreciation.

Examples of Equity Investments

- Stocks: Buying shares of a company’s stock on the stock market.

- Mutual Funds: Investing in a collection of stocks managed by a professional fund manager.

Risks and Potential Returns

Investing in equities comes with risks such as market volatility, company performance, and economic factors. However, the potential returns can be significant, with the possibility of earning high returns over the long term. It’s important for investors to diversify their equity investments to manage risks and optimize potential returns.

Fixed Income Securities

Fixed income securities are investment vehicles that provide investors with a fixed income stream in the form of regular interest payments. These securities play a crucial role in diversifying investment portfolios by providing a stable source of income and reducing overall risk.

Types of Fixed Income Securities

- Bonds: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. Investors who purchase bonds are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

- Treasury Bills: Treasury bills, also known as T-bills, are short-term government securities that mature in one year or less. They are considered one of the safest investments as they are backed by the full faith and credit of the U.S. government.

- Corporate Bonds: Corporate bonds are debt securities issued by corporations to fund their operations or expansion. These bonds offer higher yields compared to government bonds but also come with a higher level of risk.

Impact of Interest Rates on Fixed Income Securities

Interest rates have an inverse relationship with the value of fixed income securities. When interest rates rise, the value of existing fixed income securities decreases, as their fixed interest payments become less attractive compared to new securities issued at higher rates. Conversely, when interest rates fall, the value of existing fixed income securities increases, as their higher interest payments become more desirable.

Real Assets

Real assets are tangible assets that have intrinsic value and are not financial instruments. They include assets such as real estate, commodities, and natural resources. Investing in real assets can provide diversification benefits to an investment portfolio and act as a hedge against inflation.

Examples of Real Assets

- Real Estate: Properties such as residential homes, commercial buildings, and land.

- Commodities: Physical goods like gold, silver, oil, and agricultural products.

- Natural Resources: Assets like timber, water rights, and minerals.

Advantages and Risks of Investing in Real Assets

Investing in real assets can offer several advantages, including:

- Diversification: Real assets have low correlation with traditional financial assets like stocks and bonds, reducing overall portfolio risk.

- Inflation Hedge: Real assets have the potential to preserve purchasing power during inflationary periods.

- Tangible Value: Unlike financial securities, real assets have inherent value due to their physical nature.

However, there are risks associated with investing in real assets, such as:

- Liquidity Risk: Real assets can be illiquid, meaning they may not be easily sold or converted into cash quickly.

- Market Risk: The value of real assets can fluctuate based on market conditions, impacting investment returns.

- Operational Risk: Managing and maintaining real assets can require additional time, resources, and expertise.