Yo, peeps! Ready to dive into the world of financial planning? Buckle up as we take a ride through the ins and outs of creating a solid financial plan that sets you up for success. Get ready to level up your money game!

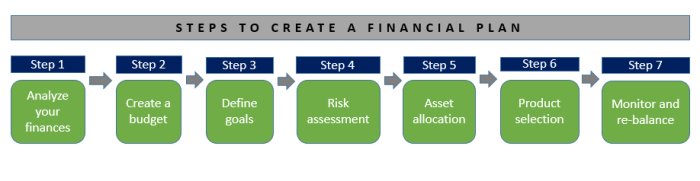

Now, let’s break down the key steps in building a financial plan that’s as fresh as your new kicks.

Understanding Financial Planning

Financial planning is the process of setting goals, evaluating resources, and creating a roadmap to achieve financial success. It involves analyzing your current financial situation, identifying future goals, and developing strategies to reach those goals.

Key Components of a Financial Plan

- Income and Expense Analysis: Understanding your cash flow is crucial to creating a budget and identifying areas where you can save or invest.

- Goal Setting: Clearly defining short-term and long-term financial goals helps you stay focused and motivated.

- Investment Strategy: Developing an investment plan tailored to your risk tolerance and financial objectives is essential for building wealth over time.

- Risk Management: Assessing and managing risks such as health emergencies, job loss, or market fluctuations is crucial to protect your financial well-being.

- Retirement Planning: Planning for retirement ensures that you have enough savings and investments to maintain your desired lifestyle after you stop working.

Benefits of Having a Financial Plan

- Financial Security: A well-thought-out financial plan can provide a sense of security and peace of mind knowing that you are prepared for unexpected expenses or emergencies.

- Goal Achievement: By setting clear financial goals and creating a plan to achieve them, you increase your chances of reaching important milestones like buying a home, starting a business, or retiring comfortably.

- Improved Decision Making: Having a financial plan in place helps you make informed decisions about spending, saving, and investing, leading to better financial outcomes in the long run.

- Reduced Stress: Knowing where you stand financially and having a plan to address your financial needs can reduce stress and anxiety related to money management.

Setting Financial Goals

Setting financial goals is a crucial step in the financial planning process as it provides direction and motivation to achieve financial success. By setting specific, measurable, achievable, relevant, and time-bound goals, individuals can create a roadmap for their financial future.

Types of Financial Goals

- Short-term Financial Goals:

- Example: Saving $500 for an emergency fund within the next 3 months.

- Example: Paying off $2,000 in credit card debt within the next 6 months.

- Long-term Financial Goals:

- Example: Saving $10,000 for a down payment on a house within the next 2 years.

- Example: Building a retirement fund of $1 million by age 60.

Setting financial goals helps individuals prioritize their spending, stay focused on what is important, and track their progress towards financial independence.

Assessing Current Financial Situation

When it comes to creating a solid financial plan, one of the crucial steps is assessing your current financial situation. This involves taking a deep dive into your income, expenses, assets, and liabilities to get a clear picture of where you stand financially.

Understanding Cash Flow

Cash flow is the lifeblood of any financial plan. It’s essential to understand how much money is coming in and going out on a regular basis. This knowledge helps you make informed decisions about saving, investing, and spending. To assess your cash flow, track your income and expenses over a specific period, like a month or a year. This will give you a clear idea of your spending habits and where you can make adjustments.

Organizing Financial Documents

Organizing your financial documents is key to evaluating your current financial situation accurately. Start by gathering essential documents such as bank statements, pay stubs, tax returns, and investment statements. Create a system to store these documents securely and in an organized manner, making it easy to access when needed. By having all your financial information in one place, you can quickly analyze your financial health and make informed decisions moving forward.

Creating a Budget

Creating a budget is a crucial step in any financial plan as it helps individuals manage their money effectively, prioritize spending, and work towards achieving their financial goals.

Tracking Income and Expenses

- Start by tracking all sources of income, including salaries, bonuses, and any other money coming in regularly.

- Next, keep track of all expenses, from fixed costs like rent and utilities to variable expenses like dining out and entertainment.

- Use tools like budgeting apps or spreadsheets to organize and categorize income and expenses for a clear picture of where your money is going.

Budgeting Strategies

- Set specific financial goals to guide your budgeting decisions, such as saving for a vacation or paying off debt.

- Allocate a percentage of your income to different categories like necessities, savings, and discretionary spending to ensure you stay within your means.

- Regularly review your budget and make adjustments as needed, especially when faced with unexpected expenses or changes in income.

- Consider using the 50/30/20 rule, where 50% of income goes to essentials, 30% to personal spending, and 20% to savings and debt repayment.

Managing Debt

In the world of financial planning, managing debt plays a crucial role in securing a stable financial future. Debt can significantly impact your financial stability and overall well-being, making it essential to address it effectively.

Impact of Debt on Financial Stability

Debt can hinder your financial progress by accumulating interest over time, leading to a cycle of repayment that can be challenging to break. High levels of debt can strain your budget and limit your ability to save for the future. It can also negatively affect your credit score, making it harder to access credit when needed.

Prioritizing and Paying Off Debt

- Create a list of all your debts, including the outstanding balance, interest rate, and minimum monthly payment.

- Consider prioritizing high-interest debt first to minimize the amount of interest paid over time.

- Explore debt repayment strategies such as the snowball method (paying off the smallest debt first) or the avalanche method (paying off the debt with the highest interest rate first).

Avoiding Debt Accumulation

- Avoid unnecessary spending and impulse purchases to prevent accumulating new debt.

- Build an emergency fund to cover unexpected expenses and reduce the need to rely on credit.

- Stick to a budget and track your expenses to stay mindful of your financial goals and priorities.

Maintaining a Healthy Debt-to-Income Ratio

- Calculate your debt-to-income ratio by dividing your total monthly debt payments by your gross monthly income.

- Aim for a debt-to-income ratio below 36% to ensure you have enough income to cover your debt obligations comfortably.

- If your debt-to-income ratio is high, consider increasing your income through side gigs or reducing your debt through aggressive repayment strategies.

Building an Emergency Fund

Having an emergency fund is crucial for financial planning as it serves as a safety net during unexpected circumstances like job loss, medical emergencies, or major repairs.

Importance of Determining the Ideal Size

It’s essential to consider individual circumstances when determining the ideal size of an emergency fund. Factors like monthly expenses, job stability, and dependents should be taken into account.

- Financial experts often recommend saving three to six months’ worth of living expenses as a general guideline for the ideal size of an emergency fund.

- Individuals with unstable income or high dependents may need to aim for a larger emergency fund to cover unforeseen expenses.

Recommended Places to Keep Your Emergency Fund

While building your emergency fund, it’s important to keep the money easily accessible in case of emergencies. Here are some recommended places to consider:

- Savings Account: A traditional savings account offers easy access to your funds without any risk, making it a suitable option for emergency savings.

- Money Market Account: This type of account typically offers higher interest rates than regular savings accounts while still allowing easy access to your funds.

- Certificate of Deposit (CD): CDs offer higher interest rates than savings accounts, but they come with a penalty for early withdrawal. Consider using a CD for a portion of your emergency fund if you can afford to lock it in for a specific period.

Investing for the Future

Investing for the future is a crucial step in achieving long-term financial growth and stability. By making smart investment decisions, you can secure your financial future and work towards achieving your financial goals.

Different Investment Options

- Stocks: Investing in shares of companies can provide significant returns over time, but comes with a higher level of risk.

- Bonds: Fixed-income securities issued by governments or corporations that offer steady returns but lower potential for growth.

- Mutual Funds: Pooled funds that invest in a diversified portfolio of stocks, bonds, or other securities managed by professionals.

- Real Estate: Investing in properties can generate rental income and long-term appreciation in value.

Risk Tolerance and Importance

Understanding your risk tolerance is crucial in making investment decisions. It refers to your ability and willingness to endure fluctuations in the value of your investments. It is important to align your risk tolerance with your investment goals to create a balanced portfolio that suits your financial situation.

Benefits of Diversification

- Diversification involves spreading your investments across different asset classes to reduce risk.

- By diversifying your portfolio, you can minimize the impact of a decline in any one investment and potentially increase overall returns.

- It helps you achieve financial security by avoiding putting all your eggs in one basket and ensuring a mix of investments with varying risk levels.

Reviewing and Adjusting the Financial Plan

Regularly reviewing and updating your financial plan is crucial to ensure that it remains relevant and effective in helping you reach your goals. Circumstances change, and your financial plan should adapt accordingly to keep you on track.

Guidelines for Adjusting the Financial Plan

- Monitor your financial goals: Regularly assess whether your goals are still realistic and if any adjustments are needed.

- Review your budget: Track your spending and income to see if any changes are necessary to align with your financial goals.

- Assess your investments: Check the performance of your investments and make adjustments based on market conditions and your risk tolerance.

- Update your emergency fund: Ensure that your emergency fund is adequate for unexpected expenses or changes in your financial situation.

Seeking Professional Advice

When in doubt, seek the guidance of a financial advisor or planner to help you navigate complex financial decisions and ensure that your plan is optimized for success.