Diving into the world of investment research, this introduction will take you on a journey through the ins and outs of maximizing your returns like a pro. Get ready to explore the key strategies and techniques that can set you on the path to financial success.

In the following paragraphs, we will uncover the essential elements of investment research that every savvy investor should know.

Importance of Investment Research

Investment research is a critical component of making informed financial decisions. By conducting thorough research, investors can better understand the market, potential risks, and opportunities for growth. This helps minimize the chances of making impulsive or uninformed investment choices that could lead to financial losses.

Minimizing Risks Through Research

- Proper research can help identify potential red flags in investment opportunities, such as high debt levels or poor financial performance of a company.

- Analyzing historical data and market trends can provide insights into the stability and growth potential of an investment, allowing investors to make more strategic decisions.

- By diversifying investments based on thorough research, investors can spread out risks and protect their portfolios from market volatility.

Impact on Long-Term Success

- Research allows investors to align their investment strategies with their long-term financial goals, ensuring a more sustainable and successful approach to wealth accumulation.

- Continuous monitoring and evaluation of investments based on research findings can help investors adapt to changing market conditions and make timely adjustments to their portfolios.

- Investment research serves as a foundation for building a well-informed investment plan that can withstand market fluctuations and deliver consistent returns over time.

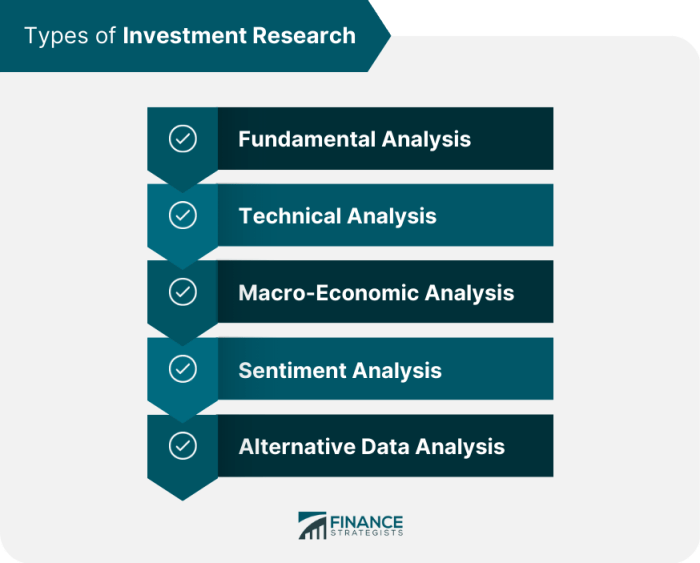

Types of Investment Research

Investment research comes in various forms, each serving a unique purpose in analyzing potential investments. Understanding the different types of research methods is crucial for making informed investment decisions.

Fundamental Analysis vs. Technical Analysis

Fundamental analysis involves evaluating a company’s financial statements, management team, and industry trends to determine its intrinsic value. On the other hand, technical analysis focuses on analyzing price movements and trading volumes to predict future price movements. While fundamental analysis provides a long-term perspective on an investment, technical analysis is more short-term oriented.

Qualitative and Quantitative Research

Qualitative research involves assessing non-numerical data such as management quality, brand reputation, and competitive advantage. This type of research helps investors gain insights into the qualitative aspects of an investment opportunity. On the other hand, quantitative research involves analyzing numerical data such as financial ratios, revenue growth, and earnings per share. Quantitative research helps investors quantify the financial health and performance of a company.

Data Sources for Investment Research

When conducting investment research, it is crucial to utilize reliable sources for financial data and market information. The accuracy and timeliness of the data can greatly impact the investment decisions made by investors. Here, we will explore the importance of using up-to-date data in investment research and share best practices for data validation and verification in investment analysis.

Identify Reliable Sources for Financial Data and Market Information

- Financial Statements: Companies’ quarterly and annual financial statements provide valuable insights into their performance and future prospects.

- SEC Filings: Reports filed with the Securities and Exchange Commission contain detailed information about a company’s operations, financials, and risks.

- Market Data Providers: Subscribing to reputable market data providers like Bloomberg, Reuters, or Morningstar can offer comprehensive market data and analysis.

- Economic Indicators: Monitoring key economic indicators such as GDP growth, inflation rates, and unemployment rates can help investors gauge the overall health of the economy.

Importance of Using Up-to-Date Data in Investment Research

Using up-to-date data is essential in investment research as it ensures that investors are making decisions based on the most recent information available. Outdated data can lead to inaccurate analyses and misguided investment choices. By staying current with market trends and financial data, investors can make more informed decisions that align with their investment goals.

Best Practices for Data Validation and Verification in Investment Analysis

- Cross-Referencing Data: Verify information from multiple sources to ensure its accuracy and reliability.

- Check for Data Integrity: Scrutinize data for any errors, inconsistencies, or missing information that could skew your analysis.

- Utilize Historical Data: Compare current data with historical trends to identify patterns and make more accurate forecasts.

- Stay Informed: Regularly update your knowledge of the market and industry trends to make timely and well-informed investment decisions.

Research Tools and Technologies

Investment research has greatly benefited from the advancements in technology. Tools and technologies play a crucial role in enhancing the efficiency and effectiveness of the research process by providing quick access to vast amounts of data and analysis capabilities.

Comparison of Investment Research Platforms

- Bloomberg Terminal: Widely used by professionals, offering real-time financial data, news, and analytics.

- Thomson Reuters Eikon: Another popular platform providing market data, research, and analytics.

- Morningstar Direct: Focuses on mutual funds and equities research, offering in-depth analysis and ratings.

- FactSet: Known for its comprehensive financial data and powerful analysis tools.

Tips for Choosing the Right Research Tools

- Consider your research needs: Identify the specific data and analysis requirements for your investment strategy.

- Ease of use: Choose tools with user-friendly interfaces and intuitive features for a seamless research experience.

- Cost-effectiveness: Evaluate the pricing plans and subscription fees to ensure the tool fits your budget.

- Integration capabilities: Look for tools that can easily integrate with other software or platforms you use for investment analysis.

- Customer support: Opt for tools that offer reliable customer support and training resources to assist you in using the platform effectively.

Risk Management in Investment Research

When it comes to investment research, managing risks is crucial for making informed decisions and protecting your capital. By integrating risk assessment into the research process, investors can identify potential pitfalls and develop strategies to mitigate them effectively.

Integrating Risk Assessment

Risk assessment involves evaluating the potential risks associated with an investment, such as market volatility, economic factors, or company-specific risks. This process helps investors understand the likelihood of negative outcomes and adjust their investment strategy accordingly.

- Conduct thorough research on the investment opportunity, including analyzing financial statements, market trends, and industry outlook.

- Utilize risk management tools and techniques, such as risk matrices or scenario analysis, to quantify and prioritize risks.

- Consider diversification as a risk mitigation strategy by spreading investments across different asset classes or sectors.

Strategies for Risk Mitigation

Mitigating risks requires a proactive approach that involves implementing strategies to minimize potential losses and maximize returns. Some effective strategies for identifying and mitigating risks include:

- Setting stop-loss orders to limit losses in case the investment moves against you.

- Implementing hedging strategies, such as options or futures contracts, to protect your portfolio from adverse market movements.

- Regularly monitoring and reassessing your investments to stay informed about changing market conditions and adjust your strategy accordingly.

Impact of Risk Management Frameworks

Risk management frameworks provide a structured approach to assessing and managing risks in investment decisions. By following a well-defined framework, investors can make more informed choices and better navigate uncertainties in the market. These frameworks impact investment decision-making by:

- Improving risk awareness and promoting a disciplined approach to risk management.

- Enhancing decision-making by considering risk factors and potential outcomes before making investment choices.

- Increasing transparency and accountability in the investment process, leading to better risk-adjusted returns.

Ethics and Compliance in Investment Research

Investment research is a crucial aspect of the financial industry, but it is equally important to conduct this research ethically and in compliance with regulations.

Ethical Considerations

- Researchers should always prioritize honesty and transparency in their work, providing accurate and unbiased information to investors.

- Avoid conflicts of interest by disclosing any personal or financial relationships that may influence research findings.

- Respect confidentiality and handle sensitive information with discretion to protect the interests of clients and stakeholders.

Importance of Compliance

- Compliance with regulations and standards ensures the integrity of investment research and protects investors from fraudulent practices.

- Adhering to compliance guidelines helps maintain trust and credibility in the financial markets, promoting stability and fairness.

- Failure to comply with regulations can result in legal consequences, reputational damage, and loss of investor confidence.

Ethical Dilemmas in Investment Research

- One common ethical dilemma is the pressure to provide positive research reports on certain securities to please clients or employers, even if the analysis does not support such recommendations.

- Another dilemma is the temptation to engage in insider trading or manipulate information for personal gain, risking legal repercussions and ethical misconduct.

- Conflicts between the interests of different stakeholders, such as investors, companies, and analysts, can also lead to ethical dilemmas that require careful navigation.