Yo, check it – we’re diving into the world of Secured vs. Unsecured loans, where financial decisions can make or break your game. Get ready for a ride filled with insights and knowledge that’ll have you navigating the loan landscape like a boss.

Now, let’s break it down for you – from the differences between secured and unsecured loans to the nitty-gritty of collateral and loan terms.

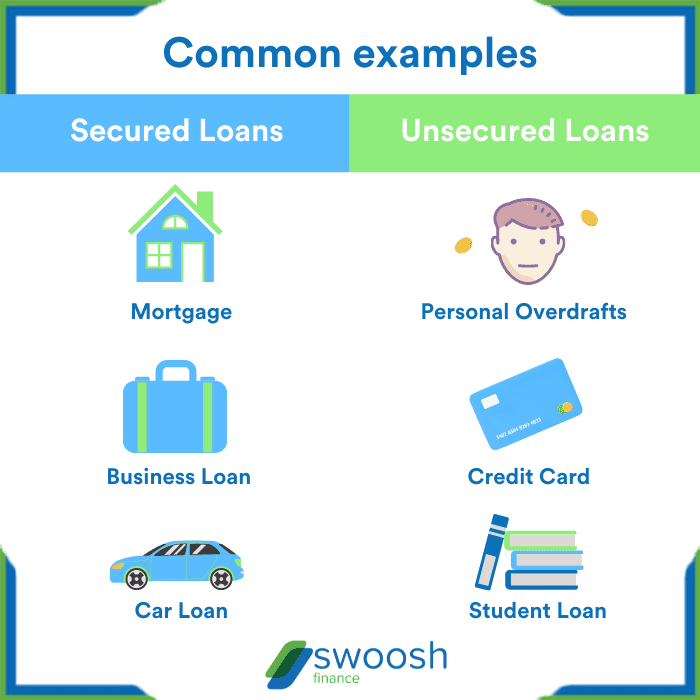

Secured Loans

Secured loans are loans that are backed by collateral, which is an asset that the borrower owns. This collateral acts as security for the lender in case the borrower defaults on the loan. Secured loans differ from unsecured loans in that unsecured loans do not require any collateral and are based solely on the borrower’s creditworthiness.

Types of Collateral for Secured Loans

- Real Estate: Properties like homes, land, or commercial buildings can be used as collateral for secured loans.

- Automobiles: Cars, trucks, or other vehicles can also be used as collateral for secured loans.

- Savings Accounts: Some lenders may allow borrowers to use their savings accounts as collateral for secured loans.

- Jewelry: Valuable pieces of jewelry can sometimes be used as collateral for secured loans.

Advantages and Disadvantages of Secured Loans

- Advantages:

- Lower interest rates: Secured loans typically have lower interest rates compared to unsecured loans because the collateral reduces the lender’s risk.

- Higher borrowing limits: Since the lender has the security of collateral, borrowers can usually access higher loan amounts with secured loans.

- Easier approval: Secured loans are often easier to qualify for than unsecured loans, especially for borrowers with poor credit.

- Disadvantages:

- Risk of losing collateral: If the borrower defaults on a secured loan, they risk losing the collateral they used to secure the loan.

- Longer approval process: Secured loans may take longer to approve and fund due to the need for collateral evaluation.

- Limited flexibility: The use of collateral restricts the borrower’s ability to sell or transfer ownership of the asset until the loan is repaid.

Unsecured Loans

Unsecured loans are types of loans that are not backed by collateral. This means that the lender does not have a claim on the borrower’s assets if they fail to repay the loan. Instead, these loans are approved based on the borrower’s creditworthiness and ability to repay.

Common Unsecured Loans

- Credit Cards: Credit cards are a common form of unsecured loans that allow borrowers to make purchases up to a certain credit limit.

- Personal Loans: Personal loans are another type of unsecured loan that can be used for various purposes like debt consolidation, home improvement, or unexpected expenses.

- Student Loans: Student loans are unsecured loans designed to help students cover the costs of higher education.

Risks of Unsecured Loans

Unsecured loans come with higher interest rates compared to secured loans, as they pose a higher risk to lenders. Since there is no collateral involved, lenders may charge higher interest rates to offset the risk of non-payment. Additionally, if a borrower defaults on an unsecured loan, the lender’s options for recovering the funds are limited compared to secured loans where they can repossess the collateral. It is important for borrowers to carefully consider their ability to repay before taking out an unsecured loan to avoid financial difficulties in the future.

Collateral

Collateral plays a crucial role in securing a loan by providing a form of security for the lender in case the borrower defaults on the loan. It acts as a guarantee that the lender can recoup their funds by seizing and selling the collateral if necessary.

Importance of Collateral in Securing a Loan

- Collateral reduces the risk for the lender, allowing them to offer lower interest rates to borrowers.

- It provides assurance to the lender that there is a valuable asset backing the loan.

- Collateral can make it easier for borrowers to qualify for larger loan amounts.

Comparison of Collateral Requirements in Secured Loans vs. Unsecured Loans

- Secured Loans: Require collateral such as real estate, vehicles, or savings accounts to secure the loan.

- Unsecured Loans: Do not require collateral, but typically have higher interest rates due to the increased risk for the lender.

- Secured loans are usually easier to qualify for compared to unsecured loans.

Impact of Collateral on Loan Terms and Conditions

- Presence of Collateral: Lower interest rates, higher loan amounts, and more favorable terms for borrowers.

- Absence of Collateral: Higher interest rates, lower loan amounts, and stricter terms due to the increased risk for the lender.

- Collateral can also affect the repayment period and overall cost of the loan.

Interest Rates and Terms

When it comes to borrowing money, interest rates and terms play a crucial role in determining the cost and conditions of a loan. Let’s explore how these factors differ between secured and unsecured loans.

Interest Rates

- Secured loans typically have lower interest rates compared to unsecured loans. This is because secured loans are backed by collateral, making them less risky for lenders.

- Unsecured loans, on the other hand, come with higher interest rates as they are not backed by any collateral. Lenders charge higher rates to compensate for the increased risk.

- Interest rates for both types of loans can vary based on factors such as credit score, financial history, and current market conditions.

Loan Terms

- Secured loans usually have longer repayment terms than unsecured loans. This is because the presence of collateral provides lenders with more security, allowing borrowers to spread out their payments over a longer period.

- Unsecured loans typically have shorter repayment terms, which may result in higher monthly payments but can also help borrowers pay off the loan quicker.

- Loan terms for both secured and unsecured loans can vary depending on the lender, the amount borrowed, and the borrower’s financial situation.

Credit Scores and Financial History

- Credit scores and financial history play a significant role in determining interest rates and terms for both secured and unsecured loans.

- Borrowers with higher credit scores and a positive financial history are more likely to qualify for lower interest rates and better loan terms.

- On the other hand, borrowers with lower credit scores or a less favorable financial history may face higher interest rates and less favorable terms when applying for a loan.