Diving into the world of Index funds explained, get ready to uncover the secrets behind these investment vehicles that are all the rage. From understanding the basics to maximizing your returns, this guide has got you covered with everything you need to know about index funds.

What are index funds?

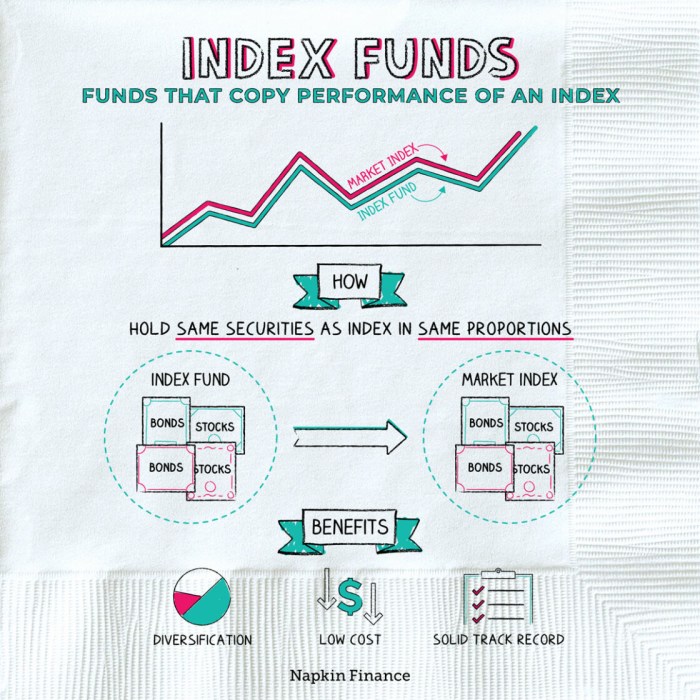

Index funds are a type of investment fund that aims to mimic the performance of a specific financial market index, such as the S&P 500 or the Dow Jones Industrial Average. The primary purpose of index funds is to provide investors with broad market exposure at a low cost.

Index funds differ from actively managed funds in that they do not rely on a fund manager to make investment decisions. Instead, index funds passively track the performance of an index by holding the same securities in the same proportions as the index itself. This passive approach typically results in lower fees compared to actively managed funds.

Examples of popular index funds

- Vanguard Total Stock Market Index Fund (VTSAX): This fund aims to track the performance of the CRSP US Total Market Index, providing exposure to the entire U.S. stock market.

- iShares Core S&P 500 ETF (IVV): This fund seeks to mirror the performance of the S&P 500 Index, which includes 500 of the largest publicly traded companies in the U.S.

- SPDR S&P 500 ETF Trust (SPY): Another fund that tracks the performance of the S&P 500 Index, offering investors a way to gain exposure to large-cap U.S. stocks.

Advantages of investing in index funds

When it comes to investing in index funds, there are several advantages that can benefit investors in the long run. Let’s dive into some of the key advantages below.

Low Fees Associated with Index Funds

Index funds are known for their low fees compared to actively managed funds. Since index funds simply aim to replicate the performance of a specific market index, they require less active management, resulting in lower fees for investors. This can lead to higher returns over time as less money is being deducted from the overall investment.

Diversification Offered by Index Funds

One of the biggest advantages of investing in index funds is the diversification they provide. By investing in an index fund, investors gain exposure to a wide range of stocks or bonds within a specific index. This diversification helps reduce the risk associated with investing in individual securities, as the performance of one stock is less likely to significantly impact the overall investment.

Outperformance of Index Funds Over the Long Term

Studies have shown that index funds tend to outperform actively managed funds over the long term. This is often attributed to the lower fees associated with index funds, as well as the fact that many actively managed funds struggle to consistently beat the market. By simply tracking the performance of a market index, index funds have historically delivered solid returns to investors without the need for constant buying and selling of securities.

Considerations before investing in index funds

When considering investing in index funds, there are several key factors that investors should evaluate to make an informed decision. Understanding the underlying index tracked by the fund, assessing historical performance, and track record are crucial steps in the investment process.

Importance of Understanding the Underlying Index

The underlying index of an index fund is the benchmark that the fund aims to replicate. It is important for investors to have a clear understanding of the index being tracked to assess the fund’s performance accurately. Different indexes have different compositions, methodologies, and objectives, which can impact the fund’s returns and risk profile. Investors should research and familiarize themselves with the underlying index to ensure it aligns with their investment goals and risk tolerance.

Assessing Historical Performance and Track Record

Before investing in an index fund, it is essential to evaluate its historical performance and track record. Investors can analyze the fund’s past returns over different time periods to gauge its consistency and volatility. Additionally, looking at the fund’s track record can provide insights into its ability to track the underlying index effectively. Consistent performance and low tracking error are favorable indicators of a well-managed index fund. Investors should review performance metrics, such as annualized returns, standard deviation, and Sharpe ratio, to assess the fund’s risk-adjusted returns and compare them with relevant benchmarks.

How to invest in index funds

Investing in index funds can be a smart way to grow your money over time while minimizing risk. Here’s a guide on how to get started:

Opening an Account

- Choose a reputable brokerage firm that offers index funds. Look for low fees and a user-friendly platform.

- Complete the account opening process by providing personal information, such as your name, address, and social security number.

- Transfer funds into your new account either through a bank transfer or by rolling over funds from another retirement account.

Selecting the Right Index Fund

- Determine your investment goals and risk tolerance. Are you looking for long-term growth or income?

- Research different index funds that align with your goals. Consider factors like expense ratio, past performance, and the fund’s underlying index.

- Choose a fund that matches your investment objectives and strategy. For example, if you want exposure to the S&P 500, consider an index fund that tracks this index.

Monitoring and Managing Investments

- Regularly review your index fund holdings to ensure they are still in line with your investment goals.

- Rebalance your portfolio if necessary to maintain the desired asset allocation. This may involve selling some funds and buying others to stay on track.

- Stay informed about market trends and economic indicators that may impact your index fund investments. Consider consulting a financial advisor for guidance.