Diving into the world of Investment diversification, we’re taking a deep dive into why spreading your investments is key. Get ready to explore the ins and outs of this crucial strategy that can level up your portfolio game.

In this guide, we’ll break down the importance, strategies, asset classes, and tools for implementing diversification to help you navigate the investment landscape like a pro.

Importance of Investment Diversification

Diversifying your investments is like mixing up your playlist with different genres to keep the vibe fresh and interesting. It’s crucial in a portfolio because it helps spread out your risk and maximize your chances of hitting those high notes in returns.

Benefits of Spreading Investments Across Different Asset Classes

When you diversify your investments across different asset classes like stocks, bonds, real estate, and even cryptocurrencies, you’re not putting all your eggs in one basket. This way, if one asset class takes a hit, the others can help balance things out and keep your portfolio grooving.

- Diversification helps manage risk by reducing the impact of market fluctuations on your overall portfolio. It’s like having a mixtape with a variety of songs – if one track isn’t hitting the right notes, you’ve got others to keep the party going.

- By spreading your investments across different asset classes, you can potentially improve your returns by capturing growth opportunities in various sectors. It’s like discovering a new favorite artist that brings in unexpected hits to your playlist.

- Having a diversified portfolio can also help you sleep better at night knowing that you’re not overly exposed to the ups and downs of any single investment. It’s like having a chill background beat that keeps you relaxed even when the market is bumping.

- Overall, diversification is like creating a well-balanced mixtape that keeps your financial journey on track, no matter what surprises the market throws your way.

Strategies for Investment Diversification

Diversification is a key strategy to mitigate risk and maximize returns in an investment portfolio. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the impact of volatility in any one area of the market.

Asset Allocation

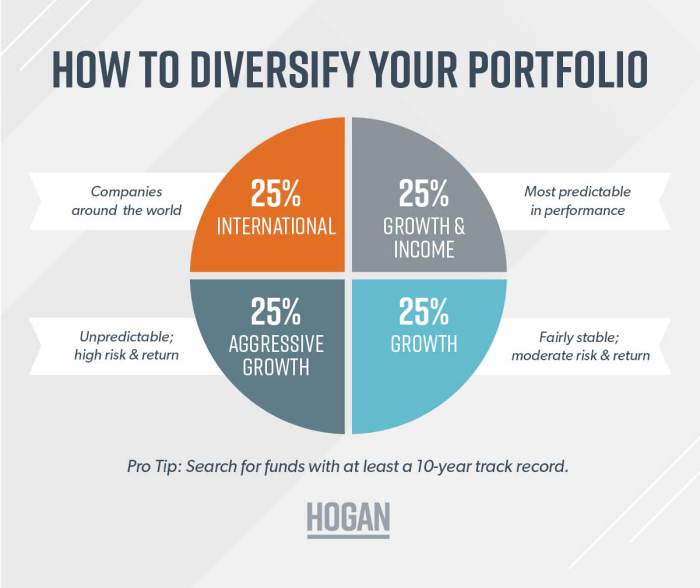

Asset allocation involves dividing your investments among different asset classes such as stocks, bonds, and cash equivalents. The goal is to create a mix of assets that align with your risk tolerance, investment goals, and time horizon. By diversifying across asset classes, you can reduce the overall risk of your portfolio.

Sector Diversification

Sector diversification involves investing in various sectors of the economy, such as technology, healthcare, and consumer goods. This strategy helps you avoid overexposure to any single industry and reduces the impact of sector-specific risks on your portfolio. For example, if one sector experiences a downturn, other sectors may help offset potential losses.

Geographic Diversification

Geographic diversification involves investing in different countries or regions around the world. By spreading your investments globally, you can reduce the risk of being overly exposed to the performance of a single country’s economy. This strategy can help protect your portfolio from geopolitical events, currency fluctuations, and economic downturns in a specific region.

Remember, the key is not to put all your eggs in one basket. Diversification can help you spread risk and potentially improve your overall investment performance.

Rebalancing a Diversified Portfolio

Rebalancing is the process of realigning your portfolio back to its original target asset allocation. Over time, as some investments outperform others, your portfolio may drift from its intended allocation. By rebalancing, you can ensure that your risk exposure remains in line with your investment goals and risk tolerance. This disciplined approach can help you stay on track and maintain the benefits of diversification.

Asset Classes for Diversification

When it comes to diversifying your investment portfolio, it’s important to consider different asset classes. Each asset class has its own characteristics and risk profiles, which can help reduce overall risk and improve returns.

Stocks:

Stocks represent ownership in a company and are considered one of the riskier asset classes. They can offer high returns but also come with high volatility. Stocks are influenced by company performance, market conditions, and economic factors.

Bonds:

Bonds are debt securities issued by governments or corporations. They are generally considered less risky than stocks and provide a fixed income stream. Bonds can help reduce portfolio volatility and provide stability during market downturns.

Real Estate:

Real estate investments can include residential, commercial, or industrial properties. Real estate offers the potential for appreciation and rental income. It is considered a tangible asset that can provide diversification benefits and act as a hedge against inflation.

Commodities:

Commodities include physical goods like gold, oil, and agricultural products. Investing in commodities can help diversify a portfolio because their prices are influenced by different factors than traditional financial assets. Commodities can provide protection against inflation and geopolitical risks.

Examples of Asset Classes in Various Market Conditions

- During a bull market, stocks tend to perform well as investor confidence is high and economic conditions are positive.

- In a bear market, bonds are often sought after as a safe haven asset, providing stability and income when stock prices are falling.

- Real estate investments can offer steady returns over the long term, regardless of short-term market fluctuations.

- Commodities like gold may see increased demand during times of uncertainty or economic instability, acting as a store of value.

Tools and Methods for Implementing Diversification

Investors have a variety of tools and methods at their disposal to effectively implement diversification in their investment portfolios. By utilizing these tools, investors can reduce risk and potentially increase returns over the long term.

Exchange-Traded Funds (ETFs) and Mutual Funds

Exchange-Traded Funds (ETFs) and Mutual Funds are popular investment vehicles that provide instant diversification by pooling money from multiple investors to invest in a diversified portfolio of assets. ETFs are traded on stock exchanges, while mutual funds are managed by professional portfolio managers. Both options offer investors exposure to a wide range of securities, making them ideal for diversification.

Role of Robo-Advisors and Online Platforms

Robo-advisors and online platforms have revolutionized the way investors create diversified portfolios. These automated platforms use algorithms to build and manage investment portfolios based on an investor’s risk tolerance, goals, and time horizon. Robo-advisors provide a cost-effective way to access diversified portfolios without the need for extensive financial knowledge.

Tips for Monitoring and Adjusting a Diversified Portfolio

– Regularly review your investment portfolio to ensure it aligns with your financial goals and risk tolerance.

– Rebalance your portfolio periodically to maintain the desired asset allocation.

– Consider tax implications when making adjustments to your diversified portfolio.

– Stay informed about market trends and economic developments that may impact your investments.

– Seek professional advice from financial advisors or investment professionals when needed.