Step into the world of investing with Mutual funds vs. ETFs at the forefront. Get ready for a rollercoaster ride of financial comparison, as we delve into the differences between these two investment options.

Let’s break down the key aspects of mutual funds and ETFs, from their structures to their tax implications, to help you make informed decisions about your investments.

Definition and Purpose

Mutual funds and ETFs are both investment vehicles that pool money from multiple investors to invest in a diversified portfolio of assets. The main purpose of both mutual funds and ETFs is to provide individual investors with access to a professionally managed, diversified investment portfolio that would be difficult to achieve on their own.

Mutual Funds

Mutual funds are actively managed by professional fund managers who make decisions on which securities to buy or sell within the fund. Investors buy shares of the mutual fund, and the fund’s value is determined by the performance of the underlying securities in the portfolio. Mutual funds are priced once a day at the net asset value (NAV) based on the closing prices of the securities held in the portfolio.

ETFs

ETFs, on the other hand, are passively managed funds that aim to replicate the performance of a specific index or asset class. Unlike mutual funds, ETFs trade on an exchange like individual stocks, and their prices fluctuate throughout the trading day based on supply and demand. ETFs are typically more tax-efficient than mutual funds due to their unique structure.

Investment Method

When it comes to the investment method, mutual funds and ETFs have some key differences that investors should be aware of.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Investors buy shares of the mutual fund, and the fund manager makes investment decisions on behalf of the investors. When investors want to buy or sell mutual fund shares, they do so at the end of the trading day at the net asset value (NAV) price.

ETFs

ETFs, on the other hand, are traded on stock exchanges just like individual stocks. This means that investors can buy and sell ETF shares throughout the trading day at market prices. ETFs are designed to track a specific index or sector and are typically passively managed, meaning they aim to replicate the performance of the underlying index.

Comparison

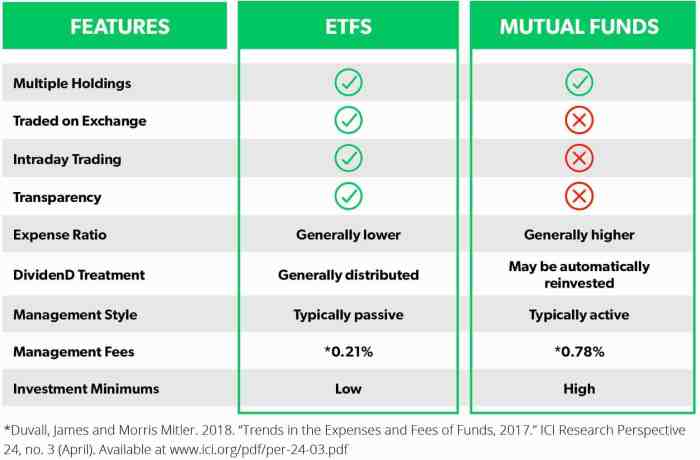

In terms of the buying and selling process, mutual funds are only traded at the end of the trading day at the NAV price, while ETFs can be bought and sold throughout the trading day at market prices. This gives investors more flexibility with ETFs, as they can react to market movements in real-time. However, mutual funds may be better suited for long-term investors who are looking for a hands-off approach to investing.

Cost and Fees

When it comes to investing in mutual funds or ETFs, one crucial factor to consider is the cost and fees associated with each option. These costs can have a significant impact on your overall investment returns, so it’s essential to understand them thoroughly.

Fees Associated with Investing in Mutual Funds

Investing in mutual funds typically involves various fees that can eat into your returns over time. Some common fees include:

- Sales Load: This is a commission or fee paid when buying or selling mutual fund shares.

- Expense Ratio: This is an annual fee charged by mutual funds to cover operating expenses.

- Management Fee: This fee is paid to the fund managers for managing the investments.

- Other Fees: Some mutual funds may charge additional fees, such as account maintenance fees or redemption fees.

Comparison of Expense Ratios between Mutual Funds and ETFs

Expense ratios are a crucial factor to consider when choosing between mutual funds and ETFs. The expense ratio represents the annual fees charged by the fund as a percentage of your total investment. Generally, ETFs have lower expense ratios compared to mutual funds. This is because ETFs are passively managed and typically have lower operating costs.

Impact of Costs on Overall Investment Returns

The costs associated with investing in mutual funds can significantly impact your overall investment returns. Higher fees mean less money in your pocket, as these fees reduce the amount of return you receive on your investment. Over time, even seemingly small differences in fees can add up and eat into your profits. That’s why it’s essential to consider the costs and fees associated with both mutual funds and ETFs before making your investment decisions.

Tax Efficiency and Distribution

When it comes to tax efficiency and distribution, both mutual funds and ETFs have their own unique characteristics that investors should consider.

Tax Implications of Owning Mutual Funds

Mutual funds can be less tax-efficient than ETFs due to the way they are structured. When mutual fund managers buy and sell securities within the fund, it can trigger capital gains taxes for all shareholders, even if they did not personally sell any shares. This can result in tax liabilities for investors, potentially reducing overall returns.

ETFs vs. Mutual Funds Tax Efficiency

ETFs are generally more tax-efficient compared to mutual funds. This is because of the unique creation and redemption process of ETF shares, which allows for in-kind transfers of securities. As a result, ETFs typically have lower capital gains distributions, which can help reduce the tax burden on investors.

Dividend Distribution in Mutual Funds and ETFs

In mutual funds, dividends are typically reinvested back into the fund, increasing the share price but also creating a tax liability for investors. On the other hand, ETFs may distribute dividends to shareholders, who can choose to reinvest them or receive them as cash. This gives investors more control over the tax implications of dividends in their investment strategy.

Performance and Risk

When it comes to comparing the historical performance of mutual funds and ETFs, it’s essential to look at how each investment option has fared over time. Additionally, understanding the risks associated with investing in mutual funds versus ETFs can help investors make informed decisions about where to allocate their funds. Let’s delve into the performance and risk factors of these two popular investment vehicles.

Historical Performance

- Mutual funds have a longer track record than ETFs, making it easier to analyze their historical performance over various market conditions.

- ETFs, on the other hand, have gained popularity for their ability to closely track specific indexes, resulting in potentially lower management fees and better tax efficiency.

- Both mutual funds and ETFs can vary widely in performance based on factors such as the fund manager’s strategy, market conditions, and overall economic climate.

Risks of Investing in Mutual Funds

- One of the primary risks associated with mutual funds is the potential for underperformance compared to benchmark indexes, leading to lower returns for investors.

- Mutual funds also carry the risk of high fees, which can eat into investors’ overall returns over time.

- Furthermore, mutual funds are subject to market risk, interest rate risk, and liquidity risk, which can impact the fund’s performance and value.

Structure and Risk Management in ETFs

- ETFs are structured differently from mutual funds, as they trade on exchanges like stocks, allowing for intra-day trading and potentially lower liquidity risk.

- Due to their passive management style in tracking indexes, ETFs may offer more transparency and potentially lower expenses compared to actively managed mutual funds.

- ETFs also have the advantage of being able to implement risk management strategies through the use of options, futures, and other derivatives to mitigate downside risk for investors.