With mortgage affordability calculator at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

Ready to dive into the world of mortgage affordability calculators and how they can pave the way to your dream home? Hold onto your hats as we break down the ins and outs of this essential tool for home buyers.

Definition of Mortgage Affordability Calculator

A mortgage affordability calculator is a financial tool used by potential homebuyers to determine how much they can afford to borrow for a home purchase. This calculator takes into account various factors such as income, monthly expenses, interest rates, and loan terms to provide an estimate of the maximum loan amount a buyer can qualify for.

Factors Considered by Mortgage Affordability Calculator

When calculating affordability, a mortgage affordability calculator takes into consideration the following factors:

- Income: The calculator considers the total income of the borrower, including salary, bonuses, and any other sources of income.

- Monthly Expenses: It accounts for monthly expenses such as utilities, groceries, car payments, and other recurring bills.

- Debt-to-Income Ratio: The calculator analyzes the borrower’s debt-to-income ratio, which is the percentage of monthly income that goes towards paying debts.

- Interest Rates: It factors in the prevailing interest rates on mortgages to determine the monthly payment amount.

- Loan Term: The calculator considers the length of the loan term, as longer terms result in lower monthly payments but higher overall interest costs.

Importance of Using a Mortgage Affordability Calculator

Using a mortgage affordability calculator before applying for a home loan is crucial for ensuring you can comfortably manage your mortgage payments without straining your finances. It helps you determine how much you can afford to borrow based on your income, expenses, and other financial obligations.

Benefits of Using a Mortgage Affordability Calculator

- Provides an Accurate Picture: A mortgage affordability calculator takes into account various financial factors to provide a more accurate estimate of how much you can afford to borrow compared to manual calculations.

- Saves Time and Effort: Instead of manually crunching numbers, a calculator automates the process, saving you time and effort in determining your affordability.

- Helps in Decision Making: By using a mortgage affordability calculator, you can make informed decisions about the type of home you can realistically afford, helping you avoid overextending yourself financially.

Scenarios Where Using a Mortgage Affordability Calculator is Crucial

- Planning for a Budget: If you are creating a budget for buying a home, using a mortgage affordability calculator can help you determine a realistic price range for your future home.

- Comparing Loan Options: When considering different loan options from lenders, a mortgage affordability calculator can help you compare monthly payments and total costs to choose the most suitable option for your financial situation.

- Preparing for Unexpected Expenses: By using a mortgage affordability calculator, you can factor in potential future expenses or changes in income to ensure you can still comfortably afford your mortgage payments even in unforeseen circumstances.

How to Use a Mortgage Affordability Calculator

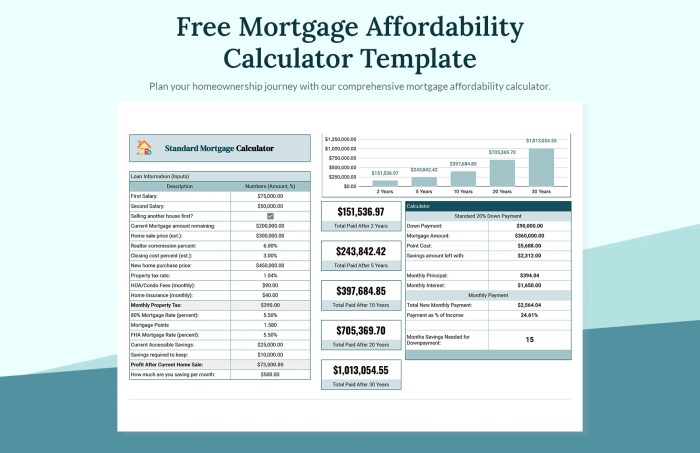

To use a mortgage affordability calculator online, follow these simple steps:

Input Information

- Start by entering your total annual income. This should include all sources of income that you can use to pay off a mortgage.

- Next, input any existing monthly debt payments you have, such as credit card bills, car loans, or student loans.

- Then, enter the desired loan term and interest rate. These factors will affect your monthly mortgage payments.

- Lastly, include any down payment amount you plan to make. The larger the down payment, the lower your monthly mortgage payments will be.

Interpreting Results

- Once you’ve entered all the necessary information, the calculator will generate an estimate of the maximum mortgage amount you can afford.

- Review the results carefully to ensure they align with your financial goals and budget constraints.

- Keep in mind that the calculator’s estimate is based on the information you provide and may not account for all expenses or financial situations.

- Consider consulting with a financial advisor or mortgage professional to get a more accurate assessment of your affordability.

Limitations of Mortgage Affordability Calculators

When using a mortgage affordability calculator, it is essential to be aware of its limitations to make informed decisions regarding your home purchase.

Not Accounting for Other Financial Obligations

Mortgage affordability calculators may not consider all your financial obligations, such as student loans, credit card debt, or medical expenses. This can lead to an inaccurate estimate of how much you can truly afford to spend on a mortgage.

Ignoring Fluctuating Interest Rates

These calculators often use a fixed interest rate for their calculations, which may not reflect the current market conditions. As interest rates fluctuate, your actual mortgage payments could be higher than what the calculator initially shows.

Omitting Extra Costs

Additional costs like property taxes, homeowners insurance, HOA fees, and maintenance expenses are typically not factored into the calculations. Ignoring these costs can result in underestimating the total expenses of homeownership.

Supplementing Calculator Information

To supplement the information obtained from a mortgage affordability calculator, consider consulting with a financial advisor or mortgage professional. They can provide personalized insights based on your unique financial situation and help you understand the full scope of homeownership costs.