Hey there, future financial wizards! Ready to dive into the world of retirement fund allocation? Buckle up as we explore the ins and outs of this crucial aspect of financial planning with a touch of American high school hip style. Get ready to rock your retirement savings game!

Are you curious to learn how to make your money work harder for you in your golden years? Stick around as we break down the essentials of retirement fund allocation in a way that’s easy to understand and totally rad.

Importance of Retirement Fund Allocation

Properly allocating your retirement funds is a crucial aspect of financial planning. It allows you to strategically invest your money to ensure a secure financial future.

Achieving Long-Term Financial Goals

When you allocate your retirement funds wisely, you can work towards achieving your long-term financial goals. By diversifying your investments across different asset classes, you can mitigate risks and maximize returns over time.

- Stocks: Investing in stocks can offer high returns but also comes with higher risks. It is essential to have a mix of different stocks to diversify your portfolio.

- Bonds: Bonds are considered safer investments that provide steady income. They can be a good addition to your retirement fund allocation to balance out risk.

- Real Estate: Investing in real estate can provide both rental income and potential property appreciation, offering another avenue for long-term growth.

- Retirement Accounts: Contributing to retirement accounts like 401(k) or IRA can offer tax advantages and help grow your retirement savings over time.

Diversified vs. Concentrated Allocation

Diversifying your retirement fund allocation by investing in various asset classes can help spread risk and potentially increase returns. On the other hand, concentrating funds in one asset class may lead to higher returns but also exposes you to higher risks if that particular asset class underperforms.

It is essential to strike a balance between diversification and concentration based on your risk tolerance and financial goals.

Factors to Consider for Retirement Fund Allocation

When it comes to allocating funds for retirement, there are several key factors that need to be taken into consideration. Factors such as age, risk tolerance, and retirement goals play a crucial role in determining the most suitable allocation strategy for an individual’s retirement portfolio.

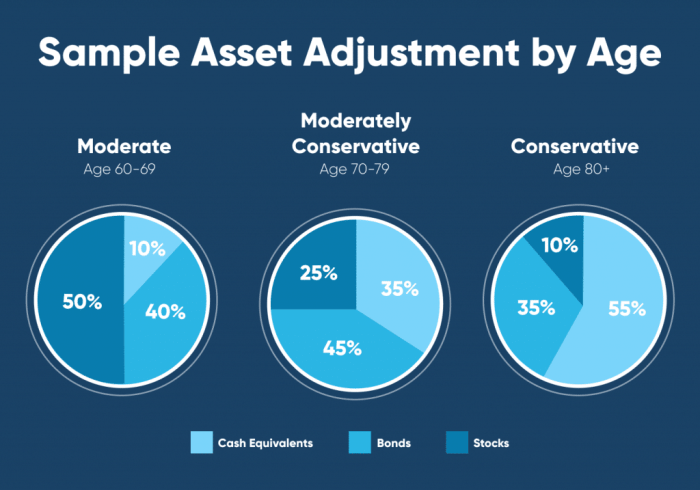

Age

As individuals age, their investment strategies should typically become more conservative. Younger individuals may opt for a more aggressive investment approach with higher risk tolerance, aiming for higher returns. On the other hand, older individuals nearing retirement may choose to shift towards more stable investments to protect their savings.

Risk Tolerance

Understanding your risk tolerance is essential when allocating funds for retirement. Some individuals may be comfortable with taking on higher risks in exchange for potentially higher returns, while others may prefer a more conservative approach to minimize the impact of market fluctuations on their savings.

Retirement Goals

Your retirement goals, such as the desired lifestyle, travel plans, or any legacy you wish to leave behind, should also influence your fund allocation decisions. Having a clear picture of what you want to achieve during retirement can help you determine how much risk you are willing to take with your investments.

Economic Conditions

Economic conditions play a significant role in retirement fund allocation strategies. Factors such as interest rates, inflation, and overall market performance can impact the growth and stability of your retirement savings. It is important to stay informed about the economic landscape and adjust your allocation strategy accordingly.

Inflation

Inflation erodes the purchasing power of money over time, making it crucial to consider when allocating funds for retirement. Investing in assets that can outpace inflation, such as equities or real estate, can help preserve the value of your savings and ensure a comfortable retirement lifestyle.

Assessing Individual Factors

To assess individual factors before deciding on fund allocation, follow these steps:

- Calculate your risk tolerance by evaluating how comfortable you are with market fluctuations.

- Define your retirement goals and estimate the amount of savings needed to achieve them.

- Consider your age and how it relates to your investment timeline.

- Stay informed about economic conditions and adjust your allocation strategy accordingly.

Strategies for Effective Retirement Fund Allocation

When it comes to planning for retirement, choosing the right allocation strategy is crucial to ensure financial stability in your golden years. Let’s explore some strategies that can help you make the most of your retirement funds.

Target-Date Funds

Target-date funds are designed to automatically adjust the asset allocation mix based on the investor’s target retirement date. These funds typically start with a higher allocation to equities when the retirement date is far off and gradually shift towards more conservative investments as the retirement date approaches. This hands-off approach can be convenient for investors who prefer a set-it-and-forget-it strategy. However, it may not provide the level of customization that some investors desire.

Asset Allocation Funds

Asset allocation funds are actively managed funds that invest in a mix of asset classes such as stocks, bonds, and cash equivalents. The fund manager adjusts the allocation based on market conditions and investment goals. This strategy allows for more flexibility and customization compared to target-date funds. However, the fees associated with actively managed funds can be higher, impacting overall returns.

DIY Portfolio Management

For investors who prefer a hands-on approach, DIY portfolio management involves selecting and managing individual investments to create a personalized asset allocation mix. This strategy offers the highest level of customization and control over investment decisions. However, it also requires a deep understanding of financial markets and a significant time commitment for research and monitoring.

Rebalancing is the process of adjusting the asset allocation of a portfolio to maintain the desired risk and return profile.

Rebalancing is essential to ensure that your retirement portfolio stays aligned with your investment goals and risk tolerance. By periodically rebalancing, you can avoid overexposure to certain asset classes and maintain a diversified portfolio.

Tax considerations can heavily influence retirement fund allocation strategies. For example, investing in tax-deferred accounts like a 401(k) or IRA can provide immediate tax benefits but may result in higher taxes upon withdrawal. On the other hand, investing in a Roth IRA offers tax-free growth potential but requires after-tax contributions. Understanding the tax implications of different investment accounts can help you optimize your retirement fund allocation based on your individual tax situation.

Monitoring and Adjusting Retirement Fund Allocation

Regularly monitoring retirement fund performance is crucial to ensure that your investments are on track to meet your financial goals. By keeping a close eye on how your funds are performing, you can make informed decisions about whether adjustments need to be made to your allocation.

Importance of Regular Monitoring

Monitoring your retirement fund allows you to track the growth of your investments over time and make adjustments as needed. It also helps you stay informed about market trends and economic conditions that may impact your portfolio.

- Check your fund performance quarterly or annually to assess if it aligns with your retirement goals.

- Review your asset allocation to ensure it is balanced and diversified for optimal growth.

- Consider working with a financial advisor to receive expert guidance on monitoring your retirement fund.

Guidelines for Adjusting Allocation

Knowing when to adjust your retirement fund allocation is essential for maintaining a healthy portfolio. Changes in your financial situation or market conditions may warrant adjustments to ensure your investments remain aligned with your goals.

- Rebalance your portfolio annually to maintain your desired asset allocation.

- Consider adjusting your allocation based on your risk tolerance and time horizon for retirement.

- Monitor economic indicators and market trends to make informed decisions about adjusting your fund allocation.

Common Mistakes to Avoid

When monitoring and adjusting your retirement fund allocation, it’s important to steer clear of common mistakes that could negatively impact your investment performance.

- Avoid making emotional decisions based on short-term market fluctuations.

- Do not neglect to review and adjust your allocation regularly to ensure it remains in line with your goals.

- Avoid overtrading or constantly changing your allocation, as this can lead to higher fees and lower returns.

Impact of Life Events

Life events such as marriage, having children, or health issues can significantly impact your retirement fund allocation decisions. It’s essential to consider these events and adjust your allocation accordingly to ensure financial stability in the long run.

Remember to reassess your retirement fund allocation whenever a major life event occurs to ensure it remains in line with your changing circumstances.