Yo, diving into the world of investing in index funds! Get ready to level up your financial game with this ultimate guide. From understanding the basics to tackling risks, we’ve got you covered.

Let’s break it down and explore the ins and outs of index funds, keeping it real and relatable for all you savvy investors out there.

Introduction to Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Unlike actively managed funds, index funds aim to replicate the performance of the index they are tied to, rather than trying to outperform the market. This passive approach typically results in lower management fees and expenses for investors.

Examples of Popular Index Funds

- Vanguard Total Stock Market Index Fund (VTSAX)

- Schwab S&P 500 Index Fund (SWPPX)

- iShares Core S&P 500 ETF (IVV)

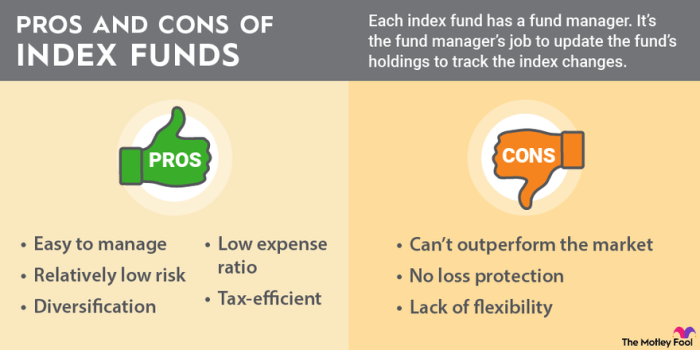

Benefits of Investing in Index Funds

Index funds offer several advantages for investors looking to achieve long-term financial goals:

- Diversification: By investing in an index fund, you are instantly diversified across a wide range of companies within the index, reducing individual stock risk.

- Low Costs: Index funds typically have lower expense ratios compared to actively managed funds, leading to higher returns for investors over time.

- Consistent Performance: Since index funds aim to mirror the performance of the underlying index, investors can expect consistent returns over the long term.

- Easy to Understand: Index funds are straightforward investment vehicles, making them ideal for novice investors or those looking for a hands-off approach to investing.

Understanding Index Fund Composition

Index funds are composed of a collection of securities that mimic a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds typically include a mix of stocks, bonds, or other assets that represent the overall performance of the index they are tracking.

Diversification Benefits of Index Funds

Index funds offer investors a high level of diversification compared to investing in individual stocks. By holding a large number of securities within a single fund, investors can spread out their risk across different companies and industries. This diversification helps reduce the impact of any single stock’s poor performance on the overall portfolio.

- Index funds provide exposure to a broad market segment, reducing the risk associated with individual stock picking.

- Investors can access a diversified portfolio with lower fees compared to actively managed funds.

- By tracking market indexes, index funds offer a passive investment strategy that requires minimal maintenance.

Tracking Specific Market Indexes

Index funds are designed to closely replicate the performance of a specific market index by holding the same securities in the same proportions as the index itself. This replication is achieved through a process known as index tracking, where fund managers adjust the fund’s holdings to match changes in the underlying index.

- Index funds use a “buy and hold” strategy to minimize trading activity and transaction costs.

- Rebalancing is done periodically to ensure the fund’s holdings continue to mirror the index composition.

- Tracking error measures how closely an index fund follows its benchmark index, with lower tracking errors indicating better performance.

Cost and Expense Ratios in Index Funds

When investing in index funds, one important factor to consider is the cost and expense ratios associated with these funds. These ratios can have a significant impact on the overall returns you receive from your investment.

Expense ratios represent the percentage of a fund’s assets that are used to cover operating expenses. These expenses can include management fees, administrative costs, and other operational charges. The lower the expense ratio, the more of your investment returns you get to keep.

It is crucial to consider the costs associated with index funds when selecting where to invest your money. High expense ratios can eat into your returns over time, reducing the overall profitability of your investment. Therefore, opting for funds with lower expense ratios can help maximize your long-term gains.

Comparing Expense Ratios of Different Index Funds

When comparing different index funds, it is essential to look at their expense ratios. Even seemingly small differences in expense ratios can add up over time and significantly impact your investment returns.

For example, if you have two index funds with similar performance but one has an expense ratio of 0.10% and the other 0.50%, the fund with the lower expense ratio will likely outperform the higher-cost fund in the long run. This is because a smaller portion of your returns is being used to cover expenses, allowing more of your money to grow.

When considering which index funds to invest in, always take into account the expense ratios and choose funds that offer a good balance between cost and performance. Remember, keeping costs low can help boost your overall investment returns in the future.

Risks Associated with Investing in Index Funds

Investing in index funds can offer diversification and low costs, but there are also risks to consider. Market volatility, economic downturns, and other factors can impact the performance of index funds.

Market Volatility and Index Fund Performance

Market volatility can lead to fluctuations in the value of index funds. During periods of high volatility, index funds may experience sudden drops in value, causing investors to incur losses. It is essential to understand that index funds are not immune to market fluctuations and can be affected by changes in the overall market sentiment.

Strategies for Mitigating Risks in Index Fund Investing

- Diversification: Investing in a variety of index funds can help spread out risk and reduce the impact of market volatility on a single fund.

- Regular Monitoring: Keeping track of your investments and staying informed about market trends can help you make informed decisions and adjust your investment strategy accordingly.

- Long-Term Perspective: Adopting a long-term perspective when investing in index funds can help you ride out short-term market fluctuations and benefit from the overall growth of the market over time.

- Consulting Financial Advisors: Seeking advice from financial professionals can provide you with valuable insights and guidance on how to navigate the risks associated with index fund investing.

Tax Implications of Index Fund Investments

Investing in index funds not only offers diversification and low costs but also provides several tax advantages compared to actively managed funds. Understanding the tax implications of index fund investments is crucial for maximizing returns and managing tax liabilities effectively.

Tax Advantage of Index Funds

Index funds are passively managed, which means they have lower turnover rates compared to actively managed funds. This results in fewer capital gains distributions, reducing the tax impact on investors. Additionally, index funds typically have lower expense ratios, allowing investors to keep more of their returns without being eroded by high fees.

Taxation of Dividends and Capital Gains

When it comes to dividends and capital gains in index funds, they are subject to taxation. Dividends received from index fund investments are taxed at ordinary income tax rates. On the other hand, capital gains realized from selling index fund shares are taxed at either short-term or long-term capital gains rates, depending on the holding period. Understanding the tax implications of dividends and capital gains can help investors make informed decisions about their investment strategy.

Tax-Efficient Strategies for Index Fund Investments

To minimize tax liabilities and enhance after-tax returns, investors can implement tax-efficient strategies when managing their index fund investments. One common strategy is tax-loss harvesting, where investors sell investments that have incurred losses to offset gains and reduce taxable income. Another strategy is to hold index funds in tax-advantaged accounts like IRAs or 401(k)s to defer taxes on investment gains until withdrawals are made in retirement. By employing these tax-efficient strategies, investors can optimize their after-tax returns and achieve their financial goals more effectively.