Diving into the world of financial risk tolerance, this introduction sets the stage for an exciting exploration of how your attitude towards risk impacts your financial decisions. Get ready to uncover the secrets behind successful investing with a twist of American high school hip style that will keep you hooked from the get-go.

As we delve deeper, you’ll gain valuable insights into the factors that shape your risk tolerance and learn practical strategies to manage it effectively. So, buckle up and get ready for a ride through the world of financial risk tolerance!

What is Financial Risk Tolerance?

Financial risk tolerance refers to the level of uncertainty an individual can handle when it comes to their investments. It is essentially the amount of risk someone is willing to take on in order to achieve their financial goals.

Understanding risk tolerance is crucial for financial planning because it helps investors make informed decisions about where to allocate their money. By knowing how much risk they are comfortable with, individuals can create a portfolio that aligns with their goals and risk tolerance.

Impact of Risk Tolerance on Investment Decisions

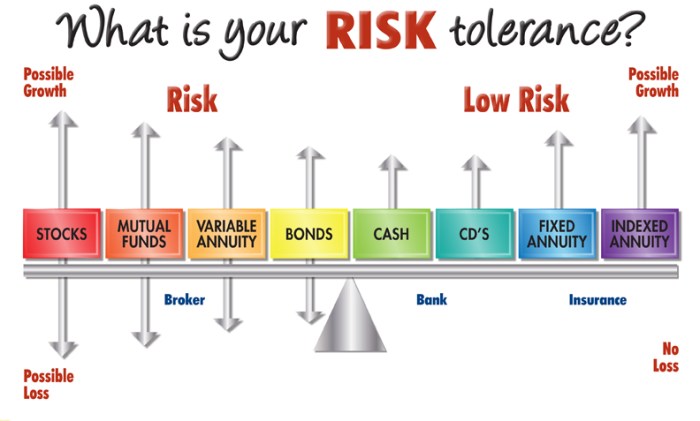

- Investment Strategy: A conservative investor with low risk tolerance may choose to invest in safer options like bonds or CDs, while an aggressive investor with high risk tolerance may opt for growth stocks or real estate.

- Asset Allocation: Risk tolerance also plays a role in determining the mix of investments in a portfolio. For example, a risk-averse investor may have a higher percentage of bonds, while a risk-tolerant investor may have more stocks.

- Market Volatility: Investors with low risk tolerance may panic during market downturns and sell off investments at a loss, whereas those with high risk tolerance may see it as an opportunity to buy more at a lower price.

Factors Influencing Financial Risk Tolerance

When it comes to determining financial risk tolerance, several key factors play a crucial role in shaping an individual’s investment decisions.

Age and Financial Goals:

As individuals progress through different stages of life, their risk tolerance tends to change. Younger individuals, typically with more time ahead of them, may be more willing to take on higher risks in pursuit of greater returns. On the other hand, as individuals near retirement age, they may adopt a more conservative approach to protect their wealth and ensure financial security in their later years. Additionally, financial goals such as saving for retirement, purchasing a home, or funding education can also impact risk tolerance. The level of risk one is willing to take may vary based on the importance and timeline of these financial goals.

Investment Knowledge and Experience:

Another significant factor influencing financial risk tolerance is an individual’s level of investment knowledge and experience. Those who are well-versed in financial markets, investment strategies, and asset classes may feel more comfortable taking on higher risks, as they understand the potential rewards and are better equipped to manage and mitigate risks. Conversely, individuals with limited investment knowledge or experience may prefer safer, more conservative investment options to avoid potential losses. Education and experience play a vital role in shaping an individual’s risk tolerance and overall investment decisions.

Summary:

- Age and financial goals can impact risk tolerance, with younger individuals typically more willing to take risks for higher returns, while older individuals may opt for a more conservative approach.

- Investment knowledge and experience play a crucial role in determining risk tolerance, with well-informed individuals more likely to take on higher risks.

Assessing Financial Risk Tolerance

Determining an individual’s risk tolerance is a crucial step in creating a suitable investment strategy. Different methods are used to assess risk tolerance, each with its own advantages and limitations.

Risk Tolerance Questionnaires

Risk tolerance questionnaires are commonly used tools to gauge an individual’s willingness to take on financial risk. These questionnaires typically ask a series of questions related to investment preferences, financial goals, and reactions to hypothetical scenarios. By analyzing the responses, financial advisors can categorize individuals into different risk tolerance profiles, such as conservative, moderate, or aggressive investors.

- Questionnaires help individuals understand their own risk preferences and make informed investment decisions.

- They provide a structured way to assess risk tolerance and align investment strategies accordingly.

- However, the accuracy of these questionnaires may be influenced by subjective responses and biases.

Risk Assessment Tools

Apart from questionnaires, there are risk assessment tools available that use mathematical models to quantify an individual’s risk tolerance. These tools analyze factors like age, investment knowledge, income, and investment time horizon to generate a risk score. By using algorithms and statistical analysis, these tools provide a more objective assessment of risk tolerance compared to questionnaires.

- Risk assessment tools offer a quantitative measure of risk tolerance, which can be useful for precise portfolio construction.

- They provide a more data-driven approach that may reduce the impact of biases in self-reported questionnaires.

- However, these tools may oversimplify the complex nature of risk tolerance and ignore individual nuances.

Revisiting Risk Tolerance Assessments

It is essential to revisit risk tolerance assessments periodically due to changing life circumstances, market conditions, and financial goals. A risk tolerance that was suitable in the past may not align with current objectives and preferences. By reassessing risk tolerance regularly, investors can ensure that their investment strategy remains appropriate and in line with their risk appetite.

- Regularly revisiting risk tolerance assessments helps investors adapt to changing financial circumstances and goals.

- It allows for adjustments in investment strategies to maintain a balanced risk-return profile.

- Periodic reassessments also enable investors to stay informed about their risk tolerance and make well-informed decisions.

Strategies for Managing Financial Risk Tolerance

Managing financial risk tolerance requires careful consideration of various strategies to align with individual risk tolerance levels. By implementing effective risk management techniques, investors can optimize their portfolios and achieve their financial goals.

Asset Allocation

Asset allocation is a key strategy for managing financial risk tolerance. By diversifying investments across different asset classes, such as stocks, bonds, and real estate, investors can spread out risk and reduce the impact of market fluctuations. For example, a conservative investor with low risk tolerance may allocate a larger portion of their portfolio to bonds or cash equivalents, while an aggressive investor with high risk tolerance may focus more on stocks.

- Asset allocation involves creating a well-balanced portfolio that aligns with an individual’s risk tolerance and investment goals.

- By adjusting the mix of assets based on risk tolerance, investors can mitigate potential losses during market downturns.

- Regularly reviewing and rebalancing the portfolio is essential to ensure that asset allocation remains in line with changing risk tolerance levels.

Risk tolerance influences the asset allocation decisions that investors make, impacting the overall risk and return profile of their portfolios.

Risk Capacity

Risk capacity refers to an individual’s ability to withstand financial losses without jeopardizing their financial goals. It is essential to consider risk capacity alongside risk tolerance when managing investments. Understanding risk capacity helps investors determine the maximum amount of risk they can afford to take based on their financial situation and goals.

- Investors with high risk capacity may be able to tolerate higher levels of risk in their portfolios, while those with low risk capacity should be more conservative.

- Risk capacity considers factors such as time horizon, financial obligations, and overall financial health when determining appropriate risk levels.

- Regularly reassessing risk capacity can help investors make informed decisions about adjusting their risk tolerance and investment strategies.

By aligning risk tolerance with risk capacity, investors can create a balanced investment approach that maximizes returns while managing risk effectively.

Behavioral Finance and Financial Risk Tolerance

Financial risk tolerance is not just about numbers; it is also influenced by behavioral biases that can impact an individual’s perception of risk. These biases can lead to misjudgments in assessing risk tolerance and making financial decisions.

Impact of Behavioral Biases

- Overconfidence Bias: This bias can make individuals believe they can handle more risk than they actually can, leading to poor investment choices.

- Loss Aversion Bias: People tend to fear losses more than they value gains, which can result in a lower risk tolerance than what is suitable for their financial goals.

- Herding Bias: Following the crowd without independent thinking can cause individuals to take on risks that may not align with their actual risk tolerance.

Addressing Behavioral Biases

- Education and Awareness: Understanding common biases can help individuals recognize and counteract them when assessing their risk tolerance.

- Emotional Detachment: Emotions can cloud judgment, so taking a step back and analyzing decisions objectively can help in overcoming biases.

- Consulting Financial Advisors: Seeking professional advice can provide an unbiased perspective and help in making more informed decisions based on actual risk tolerance.