Yo, diving into how to track expenses, this intro brings some serious insight into managing your cash flow. From old-school methods to new-age apps, we’re about to break it down for ya.

Get ready for some real talk on categorizing expenses, setting up your own tracking system, and analyzing that sweet expense data. Let’s get this money game strong, fam.

Understanding the Importance of Tracking Expenses

Tracking expenses is crucial for financial health as it allows individuals to have a clear picture of where their money is going. By keeping a record of expenses, one can identify unnecessary spending habits, prioritize essential expenses, and work towards financial goals.

How Tracking Expenses Helps in Budgeting Effectively

- Allows for better allocation of funds: By knowing exactly how much is being spent in different categories, individuals can create a realistic budget that aligns with their financial goals.

- Helps in identifying trends: Tracking expenses over time can reveal patterns in spending behavior, making it easier to adjust the budget accordingly.

- Encourages responsible financial habits: Regularly monitoring expenses promotes mindfulness about money management and encourages smarter spending decisions.

Impact of Not Tracking Expenses on Financial Stability

- Difficulty in identifying overspending: Without tracking expenses, it can be challenging to pinpoint areas where money is being wasted, leading to financial strain.

- Risk of exceeding budget limits: Not tracking expenses increases the likelihood of exceeding budget limits and accumulating debt due to lack of awareness about spending habits.

- Lack of financial control: Failing to track expenses can result in a lack of control over one’s finances, making it harder to achieve long-term financial stability and goals.

Methods of Tracking Expenses

Tracking expenses is essential for managing your finances effectively. There are various methods available, from traditional to modern tools, each with its own advantages and disadvantages.

Traditional Methods

- Spreadsheets: Many people use spreadsheets like Microsoft Excel or Google Sheets to manually input their expenses. This method allows for customization and detailed tracking of expenses.

- Notebooks: Some individuals prefer the old-school method of jotting down expenses in a notebook. While this can be time-consuming, it is a simple and tangible way to track spending.

Modern Tools

- Expense Tracking Apps: With the advancement of technology, there are now numerous mobile apps available for tracking expenses. These apps often come with features like automatic categorization, receipt scanning, and real-time updates, making it easier to stay on top of your finances.

When comparing traditional methods to modern tools, it ultimately comes down to convenience and accuracy. While spreadsheets and notebooks offer a hands-on approach, they may require more time and effort to maintain. On the other hand, expense tracking apps streamline the process and provide instant insights into your spending habits. Consider your preferences and lifestyle when choosing the method that works best for you.

Categorizing Expenses

When it comes to tracking expenses, categorizing them plays a crucial role in gaining better insights into your spending habits. By grouping expenses into specific categories, you can easily identify where your money is going and make more informed financial decisions.

Common Expense Categories

- Groceries: This category includes all your food purchases, both from the supermarket and dining out.

- Utilities: Expenses like electricity, water, internet, and phone bills fall under this category.

- Entertainment: Any expenses related to movies, concerts, dining out, or recreational activities can be categorized here.

- Transportation: This category covers costs associated with commuting, public transportation, or vehicle expenses.

- Housing: Rent or mortgage payments, property taxes, insurance, and maintenance costs are part of this category.

Benefits of Categorization

Categorizing expenses not only helps you understand where your money is going but also enables you to identify spending patterns. For example, if you notice that a significant portion of your expenses falls under the entertainment category, it may indicate that you need to reevaluate your leisure spending habits. By categorizing expenses, you can pinpoint areas where you may be overspending and make adjustments to achieve better financial balance.

Creating a Tracking System

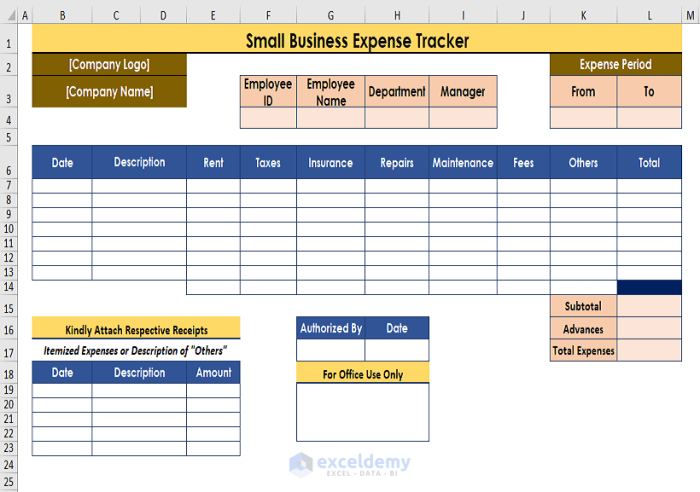

![]()

Setting up a personalized expense tracking system is crucial for managing your finances effectively. By establishing a system that works for you, you can easily monitor your expenses, identify spending patterns, and make informed decisions about your budget.

Organizing Receipts and Invoices

- Designate a specific place to store all your receipts and invoices, such as a folder or digital folder on your computer.

- Label each receipt or invoice with the date, merchant, and amount to make it easier to track and categorize later.

- Consider using expense tracking apps or software to scan and store your receipts digitally for quick access and organization.

Frequency of Updating the Tracking System

- Set aside time each week to update your tracking system with all your expenses from the past week.

- Review and categorize your expenses regularly to ensure accuracy and stay on top of your financial situation.

- Make adjustments to your budget based on the insights gained from tracking your expenses to achieve your financial goals.

Analyzing Expense Data

When it comes to tracking expenses, analyzing the data you’ve collected is crucial for making informed financial decisions. By taking a closer look at your spending habits, you can identify patterns, trends, and areas where you might be overspending. This analysis allows you to make adjustments and find ways to reduce unnecessary expenses, ultimately helping you reach your financial goals more effectively.

Identifying Spending Trends

- Review your tracked expenses over a specific time period, such as a month or a quarter, to identify any consistent patterns in your spending.

- Look for categories where you consistently spend more than you budgeted for, as this can indicate areas where you may need to adjust your spending habits.

- Use tools like graphs or charts to visualize your expense data, making it easier to spot trends and fluctuations in your spending.

Spotting Areas for Expense Reduction

- Highlight expenses that are non-essential or could be reduced without significantly impacting your quality of life.

- Identify recurring expenses that may be unnecessary or could be replaced with more cost-effective alternatives.

- Consider negotiating bills or subscriptions to lower costs and save money in the long run.

Benefits of Regular Expense Data Analysis

- Improve financial planning by gaining a better understanding of where your money is going and how you can allocate it more effectively.

- Identify opportunities for saving or investing by reallocating funds from unnecessary expenses to more strategic financial goals.

- Track progress towards financial milestones and adjust your budget accordingly to stay on track with your financial objectives.

Setting Financial Goals Based on Tracked Expenses

Tracking expenses plays a crucial role in helping individuals set realistic financial goals and achieve financial milestones. By analyzing expense data, one can gain valuable insights into their spending habits and make informed decisions about their finances. Here are some ways in which tracking expenses can aid in setting financial goals:

Understanding Spending Patterns

By tracking expenses, individuals can identify where their money is going each month. This can help them prioritize their spending and cut back on unnecessary expenses.

Setting Budgets

Once spending patterns are understood, individuals can set realistic budgets for different categories such as groceries, utilities, entertainment, etc. This can help in controlling expenses and saving money for future goals.

Creating Savings Goals

Based on tracked expenses, individuals can set specific savings goals, whether it’s for an emergency fund, a vacation, a down payment on a house, or retirement. Tracking expenses helps in determining how much can be saved each month towards these goals.

Reducing Debt

Tracking expenses can also highlight areas where individuals are overspending, leading to unnecessary debt. By identifying these areas, individuals can work towards reducing debt and improving their financial health.