Ready to dive into the world of maximizing retirement savings? Buckle up as we take a deep dive into essential strategies, account options, investment tips, and more to ensure you’re set for the golden years ahead. Get ready to level up your financial game!

Importance of Retirement Savings

Saving for retirement is crucial for ensuring financial security in old age. As people retire, they rely on their savings to cover living expenses, healthcare costs, and other necessities. Without adequate retirement savings, individuals may face significant financial challenges in their later years.

Risks of Not Having Enough Savings for Retirement

- Many retirees struggle financially due to insufficient savings, leading to a lower quality of life.

- Without proper savings, retirees may have to rely solely on social security benefits, which may not be enough to cover all expenses.

- Healthcare costs can be a major burden for retirees without adequate savings, potentially leading to financial hardship.

Statistics on Financial Struggles in Retirement

According to a recent survey, over 40% of Americans have less than $10,000 saved for retirement.

More than half of retirees report that they are not confident in their ability to afford a comfortable retirement.

Approximately 25% of Americans aged 65 and older rely on social security as their sole source of income.

Strategies to Maximize Retirement Savings

Saving for retirement can seem daunting, but with the right strategies, you can set yourself up for a comfortable future. Here are some tips to help you maximize your retirement savings.

Setting Specific Retirement Savings Goals

When it comes to saving for retirement, it’s important to set specific goals to keep you on track. Determine how much money you will need in retirement based on your current lifestyle and anticipated expenses. This will give you a clear target to work towards and help you stay focused on your savings efforts.

Starting to Save for Retirement Early

One of the best ways to maximize your retirement savings is to start saving early. The power of compound interest means that the earlier you start saving, the more time your money has to grow. By starting to save for retirement in your 20s or 30s, you can take advantage of compounding and potentially build a larger nest egg for the future.

Understanding Compound Interest

Compound interest is the concept of earning interest on both the initial principal and the accumulated interest from previous periods. This means that your money can grow exponentially over time, especially when invested wisely. Take advantage of compound interest by investing your retirement savings in vehicles that offer higher returns, such as stocks or mutual funds, to maximize your savings potential.

Retirement Account Options

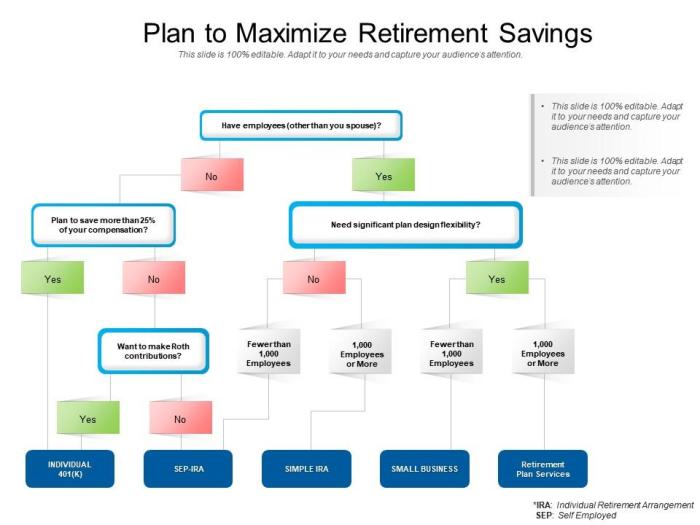

When it comes to planning for retirement, choosing the right account is crucial. Let’s compare different retirement account options and discuss their advantages and disadvantages to help you make an informed decision.

401(k) Retirement Account

- 401(k) plans are offered by employers and allow employees to contribute a portion of their salary towards retirement.

- Advantages include employer matching contributions, tax-deferred growth, and higher contribution limits compared to other retirement accounts.

- Disadvantages may include limited investment options and early withdrawal penalties.

IRA (Individual Retirement Account)

- IRAs are accounts that individuals can open independently to save for retirement.

- Advantages include tax deductions on contributions, a wide range of investment options, and flexibility in choosing a provider.

- Disadvantages may include income limits for contributions and early withdrawal penalties.

Roth IRA

- Roth IRAs are similar to traditional IRAs but contributions are made after-tax, allowing for tax-free withdrawals in retirement.

- Advantages include tax-free growth and withdrawals, no required minimum distributions, and flexibility for contributions.

- Disadvantages may include income limits for contributions and no immediate tax benefits.

Pension Plans

- Pension plans are retirement accounts funded by employers that provide a fixed income in retirement.

- Advantages include guaranteed income for life and potential cost-of-living adjustments.

- Disadvantages may include lack of portability, reliance on employer funding, and limited control over investments.

Investment Strategies for Retirement Savings

When it comes to maximizing your retirement savings, exploring different investment options is crucial. Diversifying your portfolio can help manage risk and potentially increase your returns over time. Here are some key investment strategies to consider for your retirement savings:

Stocks

Investing in individual stocks can offer high potential returns but also comes with higher risks. It’s important to research and choose companies wisely to build a diversified stock portfolio.

Bonds

Bonds are considered a safer investment compared to stocks, offering a fixed income over time. They can provide stability to your portfolio and help balance out riskier investments.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professionals and can be a convenient way to access a variety of investments.

Real Estate

Investing in real estate, whether through rental properties or real estate investment trusts (REITs), can provide a steady income stream and potential for property appreciation over time. It’s important to research the real estate market and consider rental yields and property values.

Risk Tolerance and Time Horizon

When choosing investments for your retirement savings, consider your risk tolerance and time horizon. Younger investors with a longer time horizon can afford to take more risks, while older investors may prefer more conservative investments to protect their savings.

Diversified Investment Portfolios

Building a diversified investment portfolio for retirement savings can help spread risk and optimize returns. An example of a diversified portfolio may include a mix of stocks, bonds, mutual funds, and real estate to balance risk and potential returns.