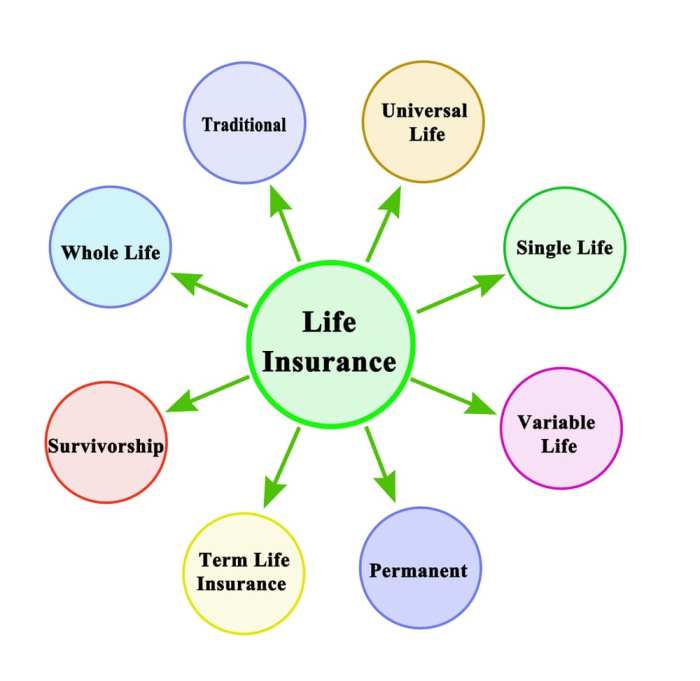

Diving into the world of Types of life insurance opens up a realm of possibilities and choices that can have a significant impact on your financial future. Whether you’re exploring term, whole, or universal life insurance, each type offers unique features and benefits that are worth exploring. Let’s navigate through the intricate details of each type to help you make informed decisions for your financial security.

Types of Life Insurance

Life insurance comes in various forms to cater to different needs and preferences. Let’s delve into the different types available in the market.

Term Life Insurance

Term life insurance is a type of policy that provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term of the policy. This type of insurance is usually more affordable compared to permanent life insurance because it does not accumulate cash value.

Whole Life Insurance vs. Universal Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured. It accumulates cash value over time and offers a guaranteed death benefit. On the other hand, universal life insurance is another form of permanent insurance that provides more flexibility in terms of premiums and death benefits. It allows policyholders to adjust the coverage and premium payments based on their financial situation.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that combines death benefit protection with an investment component. Policyholders have the option to allocate their premiums into various investment options such as stocks, bonds, or mutual funds. The cash value of the policy fluctuates based on the performance of the chosen investments, offering the potential for higher returns but also bearing the risk of losses.

Term Life Insurance

Term life insurance provides coverage for a specific period of time, typically ranging from 10 to 30 years. If the policyholder passes away during the term, a death benefit is paid out to the beneficiaries. This type of insurance is known for its affordability compared to whole life insurance, making it a popular choice for those looking for temporary coverage.

Coverage Period and Benefits

- Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years.

- If the policyholder passes away during the term, a death benefit is paid out to the beneficiaries.

- Term life insurance is generally more affordable than whole life insurance.

Situations Suitable for Term Life Insurance

- Young families looking to protect their loved ones financially in case of an unexpected death.

- Individuals with significant debts or loans who want to ensure their debts are covered if they pass away.

- Business owners seeking financial protection for their business partners or to cover business debts.

Renewing or Converting a Term Life Insurance Policy

- When the initial term of the policy ends, the policyholder may have the option to renew the policy for another term.

- Some term life insurance policies offer the option to convert to a whole life insurance policy without the need for a medical exam.

- It’s important to review renewal options and conversion terms before the initial term expires to ensure continued coverage.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which only covers a specific period, whole life insurance offers guaranteed cash value accumulation over time.

The guaranteed cash value accumulation in whole life insurance is a key feature that sets it apart from term life insurance. As the policyholder pays premiums, a portion of the payment goes towards building cash value within the policy. This cash value grows over time at a guaranteed rate, providing a source of savings that can be accessed by the policyholder.

Benefits of Death Benefit and Cash Value

- Death Benefit: Whole life insurance offers a guaranteed death benefit that is paid out to the beneficiaries upon the death of the insured individual. This provides financial protection to the loved ones left behind.

- Cash Value: The cash value in whole life insurance can be used as a source of emergency funds, to supplement retirement income, or even as a collateral for loans. This added flexibility makes whole life insurance a versatile financial tool.

Using Whole Life Insurance as an Investment Tool

Whole life insurance can also be utilized as an investment tool due to its cash value component. The cash value grows tax-deferred and can be accessed through policy loans or withdrawals. By leveraging the cash value, policyholders can potentially build wealth over time while still maintaining the protection of a life insurance policy.

Overall, whole life insurance offers a combination of insurance protection and savings benefits, making it a valuable asset for long-term financial planning.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits. Unlike term life insurance, universal life insurance allows policyholders to adjust their premiums and coverage as needed.

Flexible Premium and Adjustable Death Benefit Features

Universal life insurance provides policyholders with the flexibility to adjust their premium payments based on their financial situation. This means that you can choose to pay higher premiums when you have more disposable income or lower premiums during lean times. Additionally, the death benefit can be adjusted to meet your changing needs, allowing you to increase or decrease the coverage amount as necessary.

Interest Rates and Cash Value Accumulation

The cash value of a universal life insurance policy grows over time based on the interest rates set by the insurance company. Higher interest rates can lead to faster cash value accumulation, providing policyholders with more funds to borrow against or use for other financial needs. It’s important to monitor the interest rates on your policy to ensure that your cash value is growing at a satisfactory rate.

Advantages of Universal Life Insurance

Universal life insurance can be advantageous in various scenarios, such as:

- Providing financial protection for your loved ones while also building cash value for the future.

- Flexibility in premium payments and death benefits to adapt to changing financial circumstances.

- Ability to access cash value through loans or withdrawals for emergencies or large expenses.