With Evaluating investment risks at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on an storytelling adventure filled with unexpected twists and insights.

Get ready to dive deep into the world of investment risks, where we unravel the complexities and discover the keys to making savvy financial decisions.

Types of Investment Risks

Investing can be a risky business, and it’s important to understand the different types of risks that can affect your investment decisions.

Market Risk

Market risk is the risk of investments losing value due to economic developments or other events that affect the entire market. For example, a recession can cause stock prices to plummet, leading to losses for investors holding those stocks.

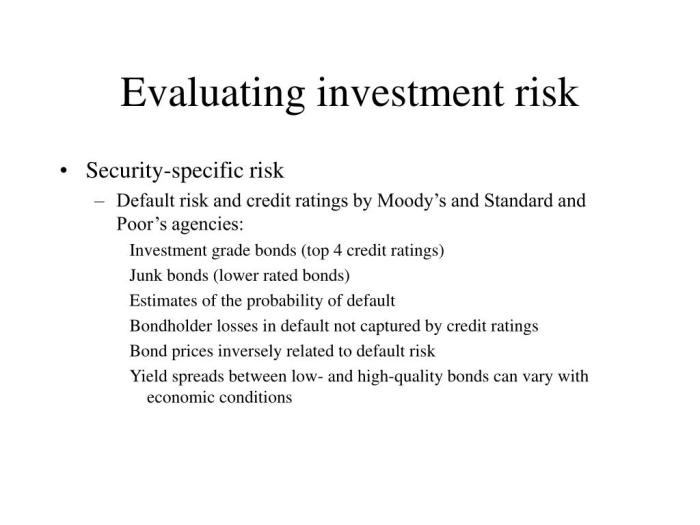

Credit Risk

Credit risk is the risk that a borrower may default on their debt obligations, leading to losses for the lender. For instance, if a company goes bankrupt and is unable to repay its bonds, bondholders may face significant losses.

Inflation Risk

Inflation risk is the risk that the purchasing power of your money will decrease over time due to rising prices. This can erode the real value of your investments, especially if the returns on your investments do not keep pace with inflation.

Interest Rate Risk

Interest rate risk is the risk that changes in interest rates will affect the value of your investments. For example, if you own bonds and interest rates rise, the value of your bonds may decrease because new bonds offer higher yields.

Liquidity Risk

Liquidity risk is the risk that you may not be able to sell your investments quickly without incurring a significant loss. This can happen if there is low trading volume for a particular asset or if market conditions are unfavorable.

Political Risk

Political risk is the risk that changes in government policies or instability in a country can negatively impact your investments. For instance, a new regulation that restricts a certain industry can lead to losses for investors in that sector.

Risk Assessment Strategies

Risk assessment is a crucial step in determining the potential risks associated with an investment. There are various methods used to assess investment risks, including quantitative and qualitative approaches, each with its own benefits and limitations. Let’s explore these strategies in more detail.

Quantitative vs. Qualitative Approaches

When it comes to assessing investment risks, quantitative methods involve using numerical data and mathematical models to analyze the potential risks and returns of an investment. This approach allows investors to calculate specific metrics such as standard deviation, beta, and Sharpe ratio to quantify the risk associated with an investment.

On the other hand, qualitative approaches rely on more subjective analysis based on factors such as market trends, industry dynamics, and management quality. While qualitative methods may not provide precise numerical values, they offer valuable insights into the qualitative aspects of risk that cannot be captured through quantitative analysis alone.

Variation in Risk Assessment Strategies

Risk assessment strategies can vary significantly across different types of investments. For example, when evaluating the risk of stocks, investors may consider factors such as company performance, industry trends, and market volatility. On the other hand, assessing the risk of bonds may involve analyzing interest rate fluctuations, credit ratings, and maturity dates.

Real estate investments, on the other hand, may require a different set of risk assessment strategies, including factors such as location, property type, and rental market conditions. By tailoring risk assessment strategies to specific investment types, investors can make more informed decisions and mitigate potential risks effectively.

Diversification as a Risk Management Tool

Diversification is a risk management strategy that involves spreading investments across different asset classes to reduce overall risk. By not putting all your eggs in one basket, diversification helps mitigate the impact of a potential loss from any single investment.

Role of Diversification in Managing Investment Risks

Diversification plays a crucial role in managing investment risks by ensuring that a portfolio is not overly exposed to the fluctuations of a single asset or market. It helps investors minimize the impact of market volatility, unexpected events, or poor performance of a particular investment.

- Diversification helps spread risks across various assets:

- By including a mix of stocks, bonds, real estate, and other assets in a portfolio, investors can reduce the impact of a downturn in any one market sector.

- For example, if one sector of the economy experiences a decline, the losses in that sector may be offset by gains in other sectors, resulting in a more stable overall return.

Successful Diversification Strategies

- Asset Allocation: Allocating investments across different asset classes such as stocks, bonds, and cash equivalents to achieve a balance of risk and return.

- International Diversification: Investing in assets from different countries to reduce the impact of country-specific risks and take advantage of global market opportunities.

- Sector Diversification: Spreading investments across various industry sectors to avoid concentration risk and benefit from the growth potential of different sectors.

Risk-Return Tradeoff

When it comes to making investment decisions, the concept of risk-return tradeoff plays a crucial role. Investors are constantly evaluating the level of risk associated with a particular investment opportunity and weighing it against the potential returns they could earn.

Balancing Risk and Return

Investors aim to strike a balance between risk and return by considering their risk tolerance, investment goals, and time horizon. Higher-risk investments typically offer the potential for greater returns, but they also come with a higher chance of loss. On the other hand, lower-risk investments may provide more stability but offer lower potential returns.

- Investors with a higher risk tolerance may opt for riskier investments in hopes of earning higher returns.

- Conversely, conservative investors may choose lower-risk options to protect their capital.

It’s essential for investors to understand their risk appetite and financial goals to make informed decisions.

Relationship Between Risk and Returns

The relationship between risk and potential returns is generally positive – higher risk investments tend to offer higher potential returns. For example, investing in a volatile tech startup may come with significant risk, but it also has the potential for substantial gains if the company succeeds. On the other hand, investing in government bonds may be lower risk but offer more modest returns.

- Real estate investments can also exemplify the risk-return tradeoff – commercial properties may offer higher returns but come with higher risk compared to residential properties.

- Stocks of established companies may provide moderate risk with potentially higher returns compared to investing in new, unproven companies.