Diving deep into the world of Understanding income statements, we embark on a journey filled with financial insights and revelations that will transform the way you view business finances. Get ready to decode the language of income statements and uncover the hidden truths behind the numbers.

As we delve into the structure, analysis, and significance of income statements, you’ll gain a newfound appreciation for the vital role they play in the financial landscape of companies.

Introduction to Income Statements

An income statement, also known as a profit and loss statement, is a financial report that shows a company’s revenues, expenses, and net profit over a specific period. It helps stakeholders understand a business’s financial performance and profitability.

Components of an Income Statement

An income statement typically includes the following components:

- Revenue: The total amount of money generated from sales of goods or services.

- Expenses: The costs incurred to generate revenue, such as salaries, rent, and utilities.

- Gross Profit: Revenue minus the cost of goods sold, showing the profit before deducting operating expenses.

- Operating Expenses: Costs related to the day-to-day operations of the business, like marketing and administrative expenses.

- Net Income: The final profit after subtracting all expenses from the revenue.

Importance of Understanding Income Statements

Income statements are crucial for businesses as they provide valuable insights into their financial health. Understanding income statements helps businesses make informed decisions, identify areas for improvement, and track their profitability over time. It is essential for investors, creditors, and other stakeholders to analyze income statements to assess the company’s performance and potential for growth.

Structure of an Income Statement

Income statements typically follow a standard format that helps investors, analysts, and stakeholders understand a company’s financial performance. The key sections of an income statement include revenue, expenses, gross profit, operating income, and net income.

Revenue

Revenue represents the total amount of money generated from the sale of goods or services. It is the top line of the income statement and is a crucial indicator of a company’s ability to generate income.

Expenses

Expenses are the costs incurred by a company to generate revenue. These can include costs related to production, marketing, sales, and general operations. Managing expenses effectively is essential for maintaining profitability.

Gross Profit

Gross profit is calculated by subtracting the cost of goods sold (COGS) from revenue. It represents the profit made before deducting operating expenses. A high gross profit margin indicates that a company is efficiently producing and selling its products or services.

Operating Income

Operating income is derived by subtracting operating expenses from gross profit. It reflects the profitability of a company’s core business operations, excluding interest and taxes. A positive operating income shows that a company is generating profits from its primary activities.

Net Income

Net income, also known as the bottom line, is the final amount left after deducting all expenses from revenue. It is a key indicator of overall profitability and is often used by investors to evaluate the financial health of a company.

Analyzing Revenue on an Income Statement

Revenue is a crucial component of an income statement as it represents the income generated by a business through its primary activities. Revenue is recorded on an income statement when it is earned, regardless of when the cash is actually received.

Types of Revenue Streams

- Sales Revenue: This is the most common type of revenue and represents income generated from selling goods or services.

- Interest Revenue: Income earned from interest on investments or loans.

- Subscription Revenue: Revenue generated from recurring payments for services or products.

- Advertising Revenue: Income earned from selling advertising space or services.

Impact of Revenue Changes

- Increased Revenue: A rise in revenue indicates business growth and profitability. It can lead to higher net income, increased shareholder value, and potential expansion opportunities.

- Decreased Revenue: A decline in revenue can signal issues such as decreased demand, pricing pressure, or market competition. This can result in lower profits, reduced cash flow, and potential cost-cutting measures.

- Seasonal Revenue Fluctuations: Some businesses experience fluctuations in revenue due to seasonal demand. Understanding these patterns is crucial for financial planning and managing cash flow effectively.

Understanding Expenses and Costs

When it comes to income statements, understanding expenses and costs is crucial for evaluating a company’s financial health. Expenses are the costs incurred to generate revenue, and they can be broken down into various categories on an income statement.

Types of Expenses

- Operating Expenses: These are the day-to-day expenses incurred in the normal course of business operations. Examples include salaries, rent, utilities, and office supplies.

- Cost of Goods Sold (COGS): This represents the direct costs associated with producing goods or services that have been sold. It includes materials, labor, and manufacturing overhead.

- Other Expenses: These are expenses not directly related to the core operations of the business. They may include interest expenses, taxes, depreciation, and amortization.

Managing Expenses for Profitability

Managing expenses effectively is essential for a company’s profitability and growth. By controlling costs and optimizing spending, a business can improve its bottom line and increase its overall financial performance. This involves analyzing each expense category, identifying areas for cost-saving, and implementing strategies to reduce unnecessary expenditures.

Net Income and Earnings Per Share

Net income is the final figure on an income statement after all expenses have been deducted from revenues. It represents the profit or loss a company has generated during a specific period. Net income is a crucial metric as it indicates the overall financial performance of a company.

Earnings Per Share (EPS)

Earnings per share (EPS) is a financial ratio that calculates the portion of a company’s profit allocated to each outstanding share of common stock. It is a key indicator of a company’s profitability and is widely used by investors to assess the company’s performance. The formula to calculate EPS is as follows:

(Net Income – Preferred Dividends) / Average Outstanding Shares

- EPS provides insight into how efficiently a company is utilizing its resources to generate profit.

- A higher EPS indicates that a company is more profitable on a per-share basis.

- Investors often use EPS to compare the profitability of different companies within the same industry.

Financial Performance Reflection

Net income and EPS are critical indicators of a company’s financial health and performance. They reflect the company’s ability to generate profits, manage expenses, and maximize shareholder value. By analyzing net income and EPS, investors can make informed decisions regarding their investments and assess the overall strength of a company’s financial position.

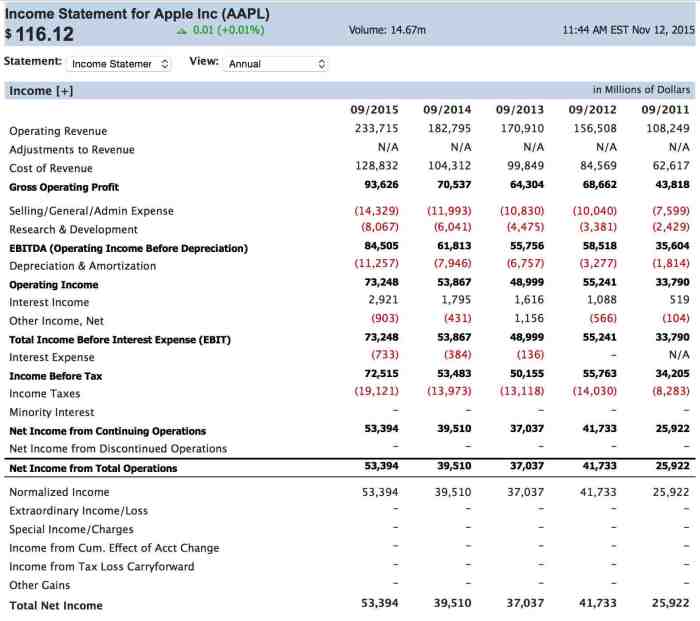

Comparative Analysis of Income Statements

When analyzing income statements, a comparative analysis can provide valuable insights into a company’s financial performance over time. By comparing income statements from different periods, such as quarterly or annually, trends in revenue, expenses, and net income can be identified to gauge the financial health of the company.

Comparing Revenue, Expenses, and Net Income

- Comparing revenue from different periods can indicate the growth or decline in sales. A favorable comparison would show an increase in revenue, while an unfavorable one might reveal a decrease.

- Analyzing changes in expenses can help identify cost-saving measures or areas where expenses have increased. A positive comparison would show a decrease in expenses, while a negative one might indicate rising costs.

- Examining net income comparisons can demonstrate the overall profitability of the company. A favorable comparison would exhibit higher net income, while an unfavorable one might show a decrease in profit.