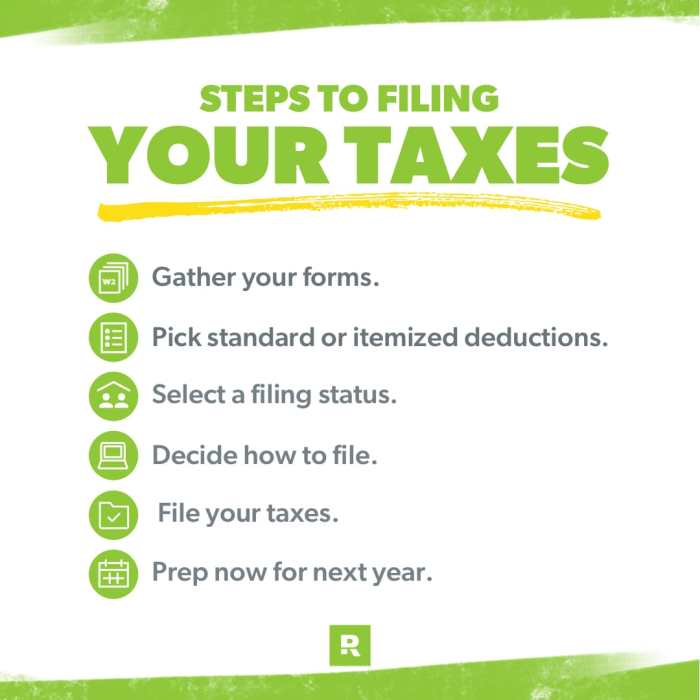

Ready to tackle the world of taxes like a boss? Buckle up as we dive into the ins and outs of filing taxes with swagger and confidence. From understanding tax deductions to dealing with tax credits, this guide will have you owning tax season like a pro.

Let’s break down the essentials of filing taxes and equip you with the knowledge needed to navigate this sometimes daunting process with ease.

Overview of Filing Taxes

Filing taxes is crucial because it ensures that individuals and businesses are meeting their legal obligation to contribute to government funding. It also helps in determining if you owe taxes or are eligible for a refund based on your income and expenses.

Documents Needed for Filing Taxes

- W-2 forms from your employer

- 1099 forms for any additional income

- Receipts for deductible expenses

- Social Security Number or Taxpayer Identification Number

Deadline for Filing Taxes

- The deadline for filing taxes in the United States is typically April 15th of each year.

- If you need more time, you can file for an extension, but you must still pay any estimated taxes owed by the original deadline to avoid penalties.

Consequences of Not Filing Taxes

- If you fail to file your taxes, you may face penalties such as late filing fees and interest on any unpaid taxes.

- You could also risk losing out on potential refunds or tax credits that you are eligible for.

- In extreme cases, not filing taxes can lead to legal action by the IRS, including wage garnishment or seizure of assets.

Different Ways to File Taxes

When it comes to filing your taxes, there are several different options available to you. Let’s explore the various ways you can file your taxes to find the best method for your needs.

Filing Taxes Online vs. By Mail

One of the most common decisions taxpayers face is whether to file their taxes online or by mail. Here are some key differences between the two methods:

- Filing Taxes Online:

- Convenient and efficient, allowing you to file from the comfort of your own home.

- Often results in faster processing and quicker refunds.

- Less room for errors with built-in error checks and prompts.

- Filing Taxes By Mail:

- Requires printing out physical forms and mailing them to the IRS.

- May take longer to process compared to e-filing.

- Can be more prone to errors without the assistance of digital tools.

Using Tax Software for Filing Taxes

Another popular option for filing taxes is using tax software. Here are some benefits of using tax software:

- Guided step-by-step process to help you accurately complete your tax return.

- Access to tax calculators and tools to maximize deductions and credits.

- Ability to e-file directly from the software for faster submission.

Hiring a Tax Professional to File Taxes

If you prefer to leave your taxes in the hands of an expert, hiring a tax professional might be the best choice for you. Here are some reasons to consider hiring a tax professional:

- Expertise in navigating complex tax laws and regulations.

- Potential for maximizing deductions and credits you might have missed.

- Peace of mind knowing your taxes are being handled by a knowledgeable professional.

Understanding Tax Deductions

When it comes to taxes, understanding deductions can be a game-changer. By claiming deductions, you can lower your taxable income and potentially reduce the amount of taxes you owe. Let’s dive into some common deductions individuals can claim and how to maximize them.

Common Tax Deductions

- Charitable contributions: Donating to qualified organizations can be deducted from your taxable income.

- Mortgage interest: If you own a home and pay mortgage interest, you may be able to deduct this amount.

- Medical expenses: Certain medical expenses that exceed a certain percentage of your income can be deducted.

- Educational expenses: Student loan interest and tuition fees may be eligible for deductions.

How Tax Deductions Reduce Taxable Income

- When you claim deductions, the total amount of deductions is subtracted from your gross income, resulting in a lower taxable income.

- For example, if your gross income is $50,000 and you claim $10,000 in deductions, your taxable income would be reduced to $40,000.

Tips for Maximizing Tax Deductions

- Keep track of all your expenses and receipts throughout the year to ensure you don’t miss any potential deductions.

- Consider bundling your deductions by timing certain expenses in a way that maximizes their tax benefits.

- Consult with a tax professional or use tax software to help identify all eligible deductions and ensure accuracy in claiming them.

Dealing with Tax Credits

When it comes to filing your taxes, understanding the difference between tax deductions and tax credits is key to maximizing your savings. While deductions reduce your taxable income, credits directly reduce the amount of tax you owe. Let’s dive into some common tax credits available and how they can benefit you.

Tax Credits Explained

- The American Opportunity Credit: This credit helps cover the cost of higher education expenses, such as tuition and fees. It can provide up to $2,500 per eligible student.

- The Child and Dependent Care Credit: For those who pay for childcare to allow them to work or look for work, this credit can help cover a portion of those expenses. The amount varies based on income and number of dependents.

Examples of Tax Credits

- The Lifetime Learning Credit: This credit can help with education expenses beyond the first four years of post-secondary education. It offers up to $2,000 per tax return.

- The Earned Income Tax Credit (EITC): This credit is designed to help low to moderate-income individuals and families. The amount of the credit depends on income and family size.

Organizing Financial Records

Keeping organized financial records is crucial for tax purposes as it helps you easily track your income, expenses, and deductions. It ensures that you have all the necessary documentation in case of an audit and helps you accurately report your financial information to the IRS.

Tips for Organizing Financial Records

- Set up a filing system: Create folders or digital folders for different categories such as income, expenses, receipts, and invoices.

- Label everything: Make sure to label each document clearly with the date, amount, and purpose to avoid confusion later on.

- Use accounting software: Consider using accounting software to streamline the process and keep all your financial records in one place.

Strategies for Maintaining Accurate Records

- Regularly update records: Make it a habit to update your financial records weekly or monthly to ensure accuracy.

- Reconcile accounts: Reconcile your bank statements, credit card statements, and receipts to ensure all transactions are accounted for.

- Keep backups: Store digital copies of your financial records in a secure location and consider keeping physical copies as a backup.

Tax Filing Tips and Best Practices

When it comes to filing your taxes, there are some key tips and best practices to keep in mind to ensure a smooth and hassle-free process. By following these guidelines, you can avoid common mistakes, take advantage of benefits, and know what to do in case you’re unable to pay your taxes on time.

Avoiding Common Tax Filing Mistakes

- Double-check all information: Make sure to review your tax return carefully to avoid errors that could lead to delays or penalties.

- Keep organized records: Maintain a system for storing all relevant documents and receipts to support your deductions and credits.

- File electronically: Consider e-filing your taxes for faster processing and fewer chances of mistakes compared to paper filing.

- Seek professional help if needed: If you have a complex tax situation or are unsure about certain deductions, consult with a tax professional for guidance.

Benefits of Filing Taxes Early

- Get your refund sooner: Filing early allows you to receive any tax refund owed to you quicker than if you wait until the deadline.

- Avoid last-minute stress: By filing early, you can avoid the rush and stress of trying to meet the deadline, giving you more time to review your return.

- Prevent identity theft: Filing early reduces the risk of someone fraudulently using your information to file a return before you do.

What to Do If You’re Unable to Pay Taxes Owed

- File your return on time: Even if you can’t pay the full amount owed, it’s crucial to file your return by the deadline to avoid additional penalties.

- Set up a payment plan: Contact the IRS to discuss setting up a payment plan if you’re unable to pay your taxes in full to avoid further consequences.

- Explore other options: Consider other payment alternatives such as an Offer in Compromise or requesting a temporary delay in collection until you can pay.